Price & Time covers key technical themes daily and can be delivered to your inbox each morning by joining the distribution list: Price & Time

Talking Points

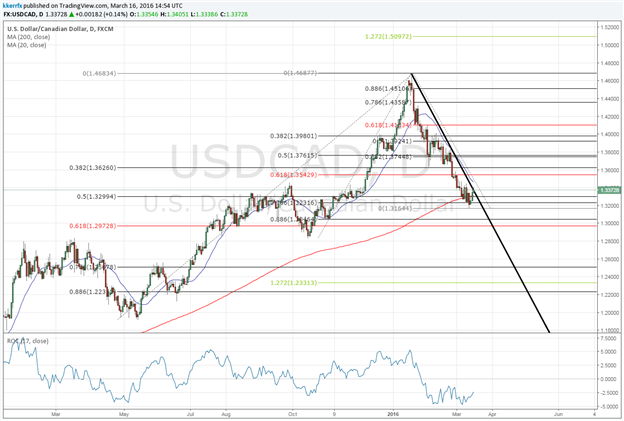

- USD/CAD at technical crossroads

- 200-day moving average remains key

The last time I wrote about USD/CAD (read it here), I said that I was looking for a reversal or, at least, an attempt at one during the latter part of the week of March 7th (last week). We seem to have gotten the initial cyclical reaction I was looking for, albeit from levels below the idealized support at the 200-day moving average that I had mentioned. The jury is still out on the cyclical significance of this move as it could very well just be a minor reprieve before another leg down or the start of a much more important push higher.

Looking for real-time positioning data? Find out HERE

I know I sound wishy washy, but what makes this situation so complicated is that the long-term trend is higher and the medium-term trend is lower. If the long-term uptrend is going to reassert itself then this about the right time for it do so. The correction last spring, for instance, lasted right around two months before the long-term uptrend reasserted itself with a vengeance. Arguably, this near two-month correction is more important because we went down to test the 200-day moving average. For whatever reason first-time tests of the 200-day MA after a prolonged period above have a tendency to elicit pretty decent recoveries. Until last week, USD/CAD had not been below its 200-day MA in almost a year and a half so the ingredients seem to be in place for a decent rally.

What I do not like is the veracity of the move down since January. I like to monitor the three-week rate of change, as it is a good gauge of momentum. It recently fell to its lowest level in more than four years. This is troubling if you are a bull, but it could also be a sign that the decline is overdone. We shall see. I think the burden of proof is on the bulls. If the long-term uptrend is indeed reasserting itself here then I will need to see signs of a departure from the negative behavior of the past couple months. In other words, notable levels of resistance need to be taken out. The 20-day moving average (which capped the market back in February) around 1.3470 would be a good start. A drop back under the 200-day MA around 1.3300 would begin to raise concerns about a downside resumption, but only aggressive weakness under last week’s 1.3167 low would invalidate the potential positive cyclicality and open the door to a much more aggressive move lower.

What is the #1 mistake most FX traders make? Find out HERE.

--- Written by Kristian Kerr, Senior Currency Strategist for DailyFX.com

To contact Kristian, e-mail instructor@dailyfx.com. Follow me on Twitter @KKerrFX