Price & Time covers key technical themes daily and can be delivered to your inbox each morning by joining the distribution list: Price & Time

Talking Points

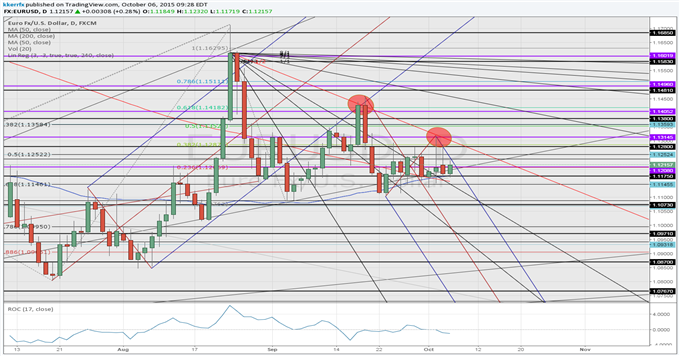

- EUR/USD fails at Gann resistance

- Cycles turn positive later in the week

Unfamiliar with Gann Square Root Relationships? Learn more about them HERE

EUR/USD: Subtle Change In Behavior?

I haven’t written about EUR/USD in almost a month because I am still not sure what is going on. The timing surrounding the August high in EUR/USD was potentially significant as it occurred 161 calendar days from the March low, 89 calendar days from the May low, 35 (one day off 34) calendar days from the July low and 13 calendar days from the August low. The big dilemma for me is whether that spike high in August marked the end of the corrective phase for the euro or not.

Subsequent price action since then suggests there is a decent chance it may have as EUR/USD has failed twice now against the 1x2 Gann angle of the August closing high (red line on chart). The first time on a closing basis in mid-September and the second time on an intraday basis last week (which was also the 4th square root relationship of the August high). These two failures at resistance indicate a subtle change in behavior has occurred. Focus for me now is on a Gann pivot around 1.1070 with traction below there needed to confirm that a more serious decline is indeed underway.

Some caution is warranted heading into the end of the week as a convergence of short-term cyclical relationships point to a potential counter-trend rally or at least an attempt at one. However, only a daily close above the 1x2 Gann angle line (today around 1.1300) would neutralize the budding negative view.

--- Written by Kristian Kerr, Senior Currency Strategist for DailyFX.com

To contact Kristian, e-mail instructor@dailyfx.com. Follow me on Twitter @KKerrFX