Talking Points

Get real time volume on your charts for free. Click HERE

Foreign Exchange Price & Time at a Glance:

Price & Time Analysis: EUR/USD

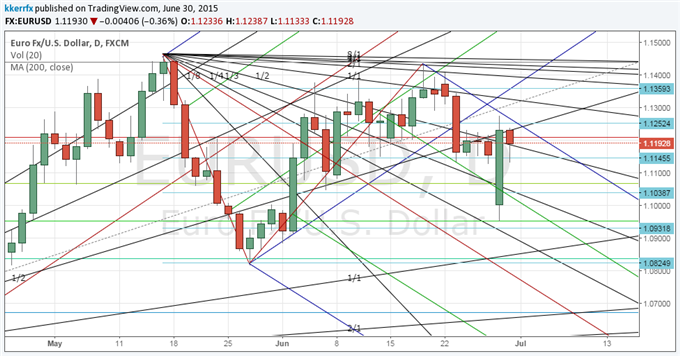

ChartPrepared by Kristian Kerr

- EUR/USD rebounded from a 4-week low yesterday to finish up on the day

- Our near-term trend bias is lower in the euro while below 1.1240 (closing basis)

- Initial downside focus is on 1.1070 ahead of the critical 1.0950 area

- A very minor turn window is seen today

- A close back over 1.1240 would turn us positive on the euro

EUR/USD Strategy: Like the short side while below 1.1240.

| Instrument | Support 2 | Support 1 | Spot | Resistance 1 | Resistance 2 |

|---|---|---|---|---|---|

| EUR/USD | *1.0920 | 1.1070 | 1.1170 | *1.1240 | 1.1270 |

Price & Time Analysis: GBP/USD

ChartPrepared by Kristian Kerr

- GBP/USD has come under modest pressure over the past couple of weeks following a failure at the 50% retracement of the 2014-2015 decline

- Our near-term trend bias is positive while above 1.5675

- A close above 1.5875 is needed to re-instill upside momentum in the rate

- A very minor turn window is seen tomorrow

- A daily close below 1.5675 would turn us negative on the pound

GBP/USD Strategy: Square

| Instrument | Support 2 | Support 1 | Spot | Resistance 1 | Resistance 2 |

|---|---|---|---|---|---|

| GBP/USD | 1.5610 | *1.5675 | 1.5725 | 1.5800 | *1.5875 |

Focus Chart of the Day: S&P 500

Today is month-end, quarter-end and half year-end. Arguably it is one of the more important days of the year for US equity markets. The Greece/China/Puerto Rico negative news flow has clearly flipped the script a bit heading into this period. No instutional markup up this time, but instead managers have been seemingly forced to go the other way and pull the plug early on the quarter. Will it continue today? The 200-day moving average looks critical. Say what you will about moving averages and technical analysis for that matter, but the fact is the 200-day moving average is widely watched. A clear crack of this level (currently at 2053 in cash) will force many managers to make some difficult decisions that will impact their performance (versus other managers more importantly). Game theory at its best. Strength after the first hour following yesterday’s successful hold could force a scramble, but it would probably take a move north of 2090 to alleviate the immediate downside pressure in the index.

To receive Kristian’s analysis directly via email, please SIGN UP HERE.

--- Written by Kristian Kerr, Senior Currency Strategist for DailyFX.com

This publication attempts to further explore the concept that mass movements of human psychology, as represented by the financial markets, are subject to the mathematical laws of nature and through the use of various geometric, arithmetic, statistical and cyclical techniques a better understanding of markets and their corresponding movements can be achieved.

To contact Kristian, e-mail instructor@dailyfx.com. Follow me on Twitter @KKerrFX