Talking Points

Get real time volume on your charts for free. Click HERE

Charts Created using Marketscope – Prepared by Kristian Kerr

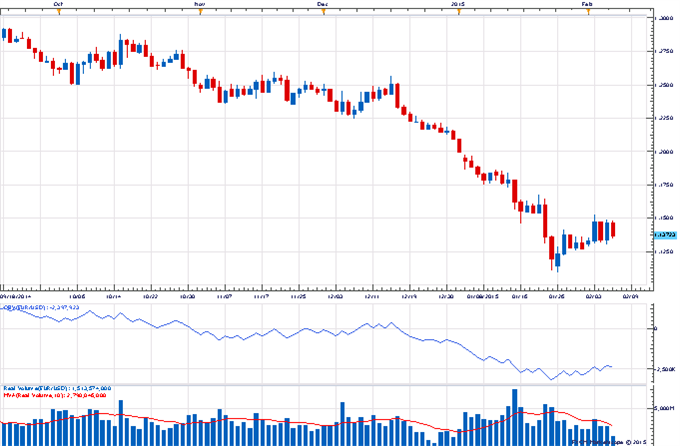

- EUR/USD has rallied steadily from the 11-year low recorded late last month

- Declining volume during the recent rise suggests the advance is likely only corrective

- A modest push higher in daily OBV levels also favors an eventual downside resumption

- A close above 1.1525 on above average volume will keep focus higher

Daily Volume Chart: USD/JPY

Charts Created using Marketscope – Prepared by Kristian Kerr

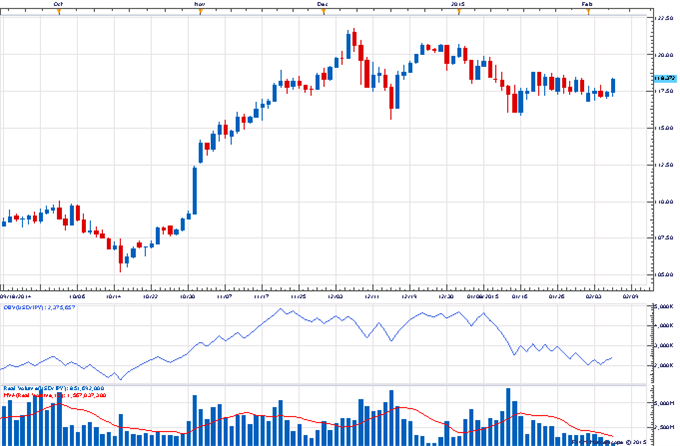

- USD/JPY remains in consolidation mode below 122.00

- Decline in volume since early December suggests action since then is likely only corrective

- However, the persistent decline in daily OBV over past few weeks is a warning sign that a deeper decline may be unfolding

- A close under 116.35 on above average volume would turn us negative on the exchange rate

Daily Volume Chart: GBP/USD

Charts Created using Marketscope – Prepared by Kristian Kerr

- GBP/USD rally from the cycle low late last month has begun to pick up pace

- The lack of volume during the recent advance does suggest the move is likely only corrective

- The modest move higher in OBV also favors an eventual downside resumption

- A daily close above 1.5500 on above average volume would turn us positive on Cable

To receive Kristian’s analysis directly via email, please SIGN UP HERE.

--- Written by Kristian Kerr, Senior Currency Strategist for DailyFX.com

To contact Kristian, e-mail instructor@dailyfx.com. Follow me on Twitter @KKerrFX