Talking Points

- USD/JPY gives back Tuesday’s gains

- S&P 500 waiting on a catalyst

- Neutral Kiwi sentiment a potential negative

Get real time FXCM volume on your charts for free. Click HERE

Foreign Exchange Price & Time at a Glance:

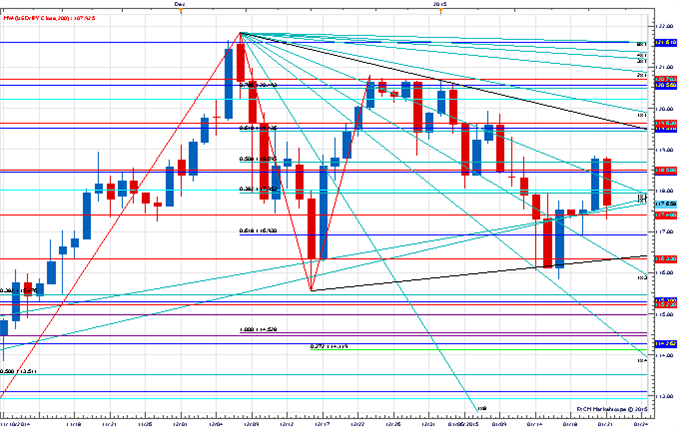

Price & Time Analysis: USD/JPY

Charts Created using Marketscope – Prepared by Kristian Kerr

- USD/JPY has fallen sharply after yesterday’s test of the 50% retracement of the December range

- Our near-term trend bias is positive while above 117.40

- Interim resistance is seen at 118.70 ahead of a critical area at 119.70

- A minor turn window is eyed around the end of the week

- A close under 117.40 would turn us negative again on the exchange rate

USD/JPY Strategy: Square.

| Instrument | Support 2 | Support 1 | Spot | Resistance 1 | Resistance 2 |

|---|---|---|---|---|---|

| USD/JPY | 116.90 | *117.40 | 117.60 | 118.00 | *118.70 |

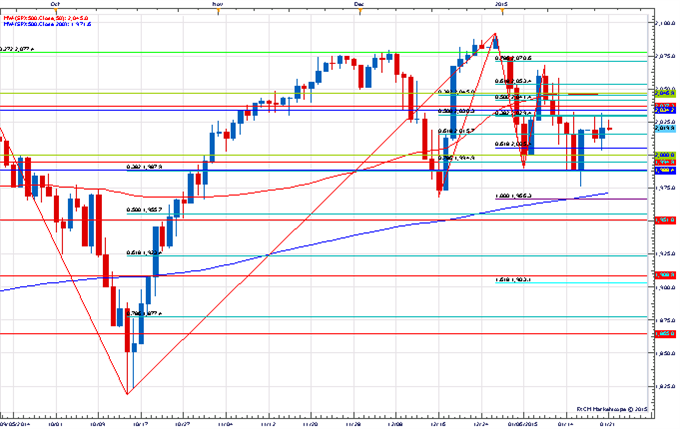

Price & Time Analysis: S&P 500

Charts Created using Marketscope – Prepared by Kristian Kerr

- S&P 500 continues to hover above the key support zone at 1989-2000

- Our near-term trend bias is positive while above this 1989

- A connfluence of Fibonacci and Gann levels near 2046 needs to be overcome to reinstill upside momentum in the index

- A turn window is eyed around the start of next week

- A close below 1989 would turn us negative on the S&P 500

S&P 500 Strategy: Square.

| Instrument | Support 2 | Support 1 | Spot | Resistance 1 | Resistance 2 |

|---|---|---|---|---|---|

| S&P 500 | *1989 | 2000 | 2020 | 2035 | *2046 |

Focus Chart of the Day: NZD/USD

The NZD/USD daily chart is beginning to look interesting again. Over the past few months while other developed market currencies have been in a virtual free fall against the Greenback, NZD/USD has held its own and traded in a fairly well defined range. With the exchange rate testing the bottom end of the range today we can’t help but wonder if the Bird is about to fall in line with the rest of the currency world? We say this mostly because of the sentiment picture. This outperformance by the Kiwi over the past few months has seen sentiment towards NZD rise well above 50% bulls on the DSI when most other currencies are sporting bullish sentiment levels closer to 10%. In our view this neutral sentiment profile makes the Kiwi much more vulnerable to a decent move lower if the range lows break as there will be plenty of “fuel” for the decline. The .7607 December low looks key with weakness below needed to trigger this negative scenario.

To receive Kristian’s analysis directly via email, please SIGN UP HERE.

This publication attempts to further explore the concept that mass movements of human psychology, as represented by the financial markets, are subject to the mathematical laws of nature and through the use of various geometric, arithmetic, statistical and cyclical techniques a better understanding of markets and their corresponding movements can be achieved.

--- Written by Kristian Kerr, Senior Currency Strategist for DailyFX.com

To contact Kristian, e-mail instructor@dailyfx.com. Follow me on Twitter @KKerrFX