GBP/USD Analysis & News

- Risk-Reward Favours Pullback in Risk Appetite

- Idiosyncratic Factors Sees GBP and Risk Appetite Correlation Breakdown in Short-Term

- Lack of EU-UK Trade Progress to Present Renewed Pressure on GBP

Risk-Reward Favours Pullback in Risk Appetite

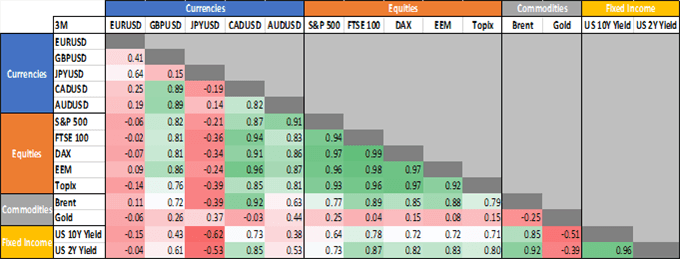

The last session saw markets swing back into a risk-off fashion as concerns over a possible second coronavirus wave increases. Alongside this, tensions between the US and China looks set to pick up once again with the Senate proposing a new bill to give President Trump the authority to impose sanctions on China over coronavirus. While Fed Chair Powell is expected to talk down the idea of negative interest rates. As such, the upside across equity markets are looking somewhat extended, and thus risk-reward favours a pullback. In this report we explore cross-asset correlations.

| Change in | Longs | Shorts | OI |

| Daily | 3% | -7% | -3% |

| Weekly | 4% | -10% | -5% |

Idiosyncratic Factors Sees GBP and Risk Appetite Correlation Breakdown in Short-Term

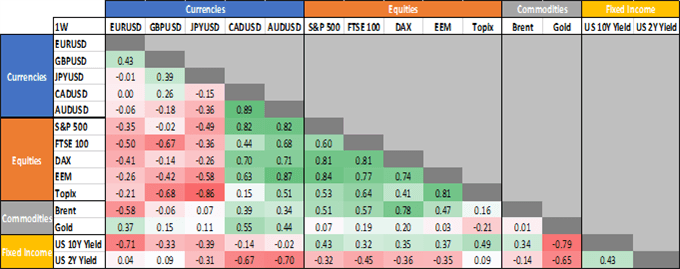

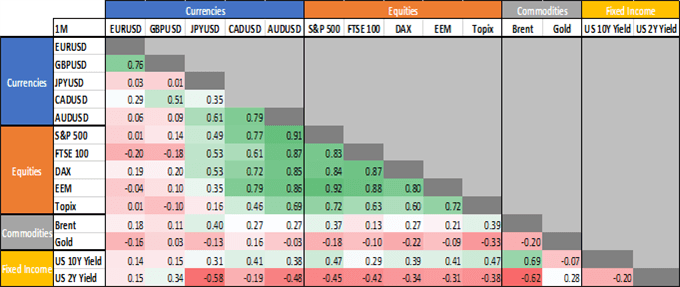

In recent times the Pound has shown an increasingly positive correlation to risk appetite. However, in the short-term the 1-week correlation has seen a breakdown in the link between GBP and risk sentiment, potentially as more idiosyncratic factors have placed pressure on the Pound, most notably from the rising Brexit premium.

Lack of EU-UK Trade Progress to Present Renewed Pressure on GBP

This week sees another round of EU-UK trade talks with a focus towards the backend of the week as to whether notable progress has been made on four key areas (fisheries, level playing field, governance of future partnership, and judicial cooperation in criminal matters). Failure to make material progress would undoubtfully raise Brexit concerns particularly with the UK remaining firm in sticking to the pledge to not ask for a transition period extension. With that said, a more pronounced turn lower in risk sentiment could leave GBP at risk of a larger pullback, particularly against the Japanese Yen.

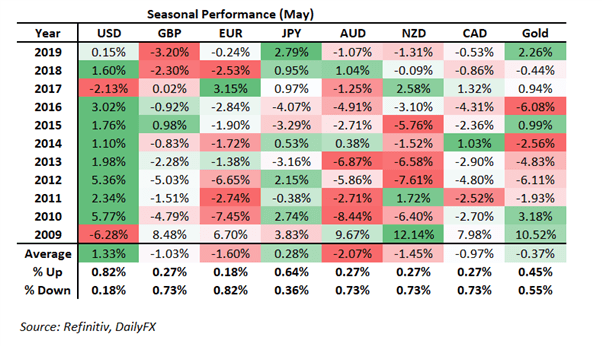

Figure 1. FX Seasonality

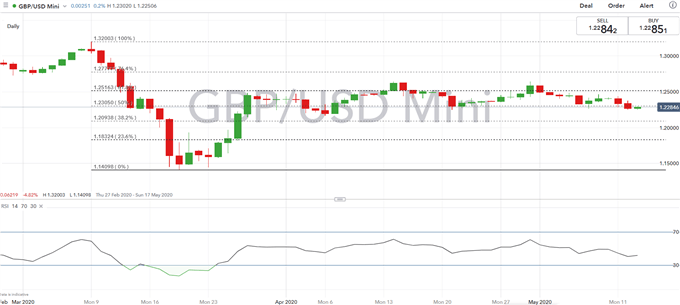

GBP/USD Price Chart: Daily Time Frame

Source: IG Charts

Cross-Asset CorrelationMatrix(1 Week, 1 Month & 3 Month Timeframe)

Source: Refinitiv, DailyFX. The Topix is used a proxy for the Nikkei 225.

--- Written by Justin McQueen, Market Analyst

Follow Justin on Twitter @JMcQueenFX