Talking Points:

- USD/CAD Trends to New Lows Ahead of U.S. GDP Data

- 10 Day EMA Provides Resistance at 1.3518

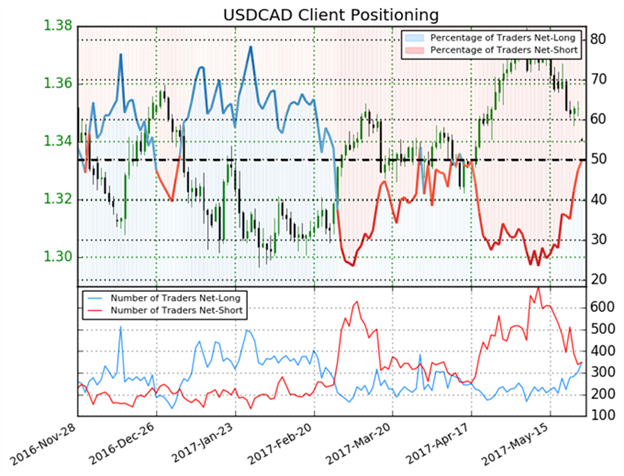

- IG Client Sentiment Reads -1.01; 49.8% Net-Short

The USD/CAD has traded to new monthly lows today, as the market continues to process yesterday’s Bank of Canada rate decision. To conclude this week’s trading, traders will next be watching Friday’s U.S. GDP data release to provide direction for the pair. Expectations for U.S. GDP (1Q S) are set at 2.3%, and should be considered a high importance event for US Dollar traders.

Technically the USD/CAD continues to trend lower in the short term, and has now declined as much as 407 pips from the standing May high at 1.3794. Also if prices close at present levels, it will market the 9th consecutive trading day that the pair closes below its 10 day EMA (exponential moving average). This line is now found at 1.3518, and should be monitored as a value of resistance as the pair trends lower. Traders should also note the 200 day MVA (simple moving average) is found at 1.3347. A move below this point would have longer term bearish implications for the pair. Alternatively if prices rebound above 1.3347, USD/CAD bulls may again look for a breakout above the 10 day EMA.

USD/CAD Daily Chart & Averages

Why and how do we use IG Client Sentiment in trading? See our guide.

Sentiment totals for the USD/CAD are close to flipping net long for the first time since April 18th. Currently IG Client Sentiment reads at -1.01, with 49.8% of traders short the pair. While sentiment totals remain relatively flat, this may suggest that the market is preparing for a transition. If the USD/CAD trades to new monthly lows, traders should first watch for sentiment to flip net positive and then move towards new positive extremes. Alternatively if the USD/CAD finds support above the 200 day MVA, it is possible that sentiment moves back towards new negative values as prices begin to rise.

--- Written by Walker, Analyst for DailyFX.com

To Receive Walkers’ analysis directly via email, please SIGN UP HERE

See Walker’s most recent articles at his Bio Page.

Contact and Follow Walker on Twitter @WEnglandFX.