Talking Points:

- US Dollar May Have Finally Began a Bearish Reversal

- S&P 500 Aims for December Top After Resistance Break

- Gold Finds Support, Crude Oil Rally May Fail Near $59

Can’t access the Dow Jones FXCM US Dollar Index? Try the USD basket on Mirror Trader. **

US DOLLAR TECHNICAL ANALYSIS – Prices may have finally started to turn lower as expected following the appearance of a bearish Evening Star candlestick pattern. Near-term support is at 11740, the 14.6% Fibonacci retracement, with a break below that on a daily closing basis exposing the 23.6% level at 11653 Alternatively, a reversal above trend line support-turned-resistance at 11819 clears the way for a test of the 11854-76 zone (14.6% Fib expansion, March 2009 high).

Daily Chart - Created Using FXCM Marketscope

** The Dow Jones FXCM US Dollar Index and the Mirror Trader USD basket are not the same product.

S&P 500 TECHNICAL ANALYSIS – Prices edged above resistance at 2080.70, the 38.2% Fibonacci expansion, to expose the December 29 high at 2092.60. A break above that on a daily closing basis exposes the 50% level at 2112.90. Alternatively, a turn back below 2080.70 targets resistance-turned-support marked by the January 9 top at 2068.60.

Daily Chart - Created Using FXCM Marketscope

GOLD TECHNICAL ANALYSIS – Prices are testing support at 1218.80, the 50% Fibonacci retracement, with a break below that on a daily closing basis exposing the intersection of rising trend line support and the 61.8% level at 1197.86. Alternatively, a reversal above the 38.2% Fib at 1239.73 aims for the October 21 high at 1255.20.

Daily Chart - Created Using FXCM Marketscope

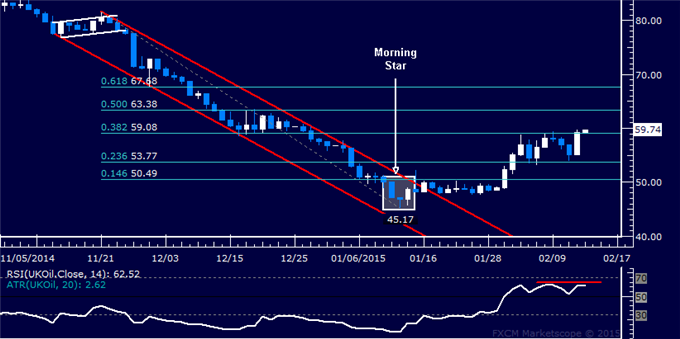

CRUDE OIL TECHNICAL ANALYSIS – Prices continue to push higher as expected, with a narrow breach of the 38.2% Fibonacci retracement at 59.08 exposing the 50% level at 63.38. A further push beyond that targets the 61.8% Fib at 67.68. Negative RSI divergence wars of fading upside momentum however, hinting a turn downward may be ahead. A reversal back below 59.08 aims for the 23.6% retracement at 53.77.

Daily Chart - Created Using FXCM Marketscope

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To receive Ilya's analysis directly via email, please SIGN UP HERE

Contact and follow Ilya on Twitter: @IlyaSpivak