COT Report: Analysis and Talking Points

- GBP Most Bearish Currency in G10 Space

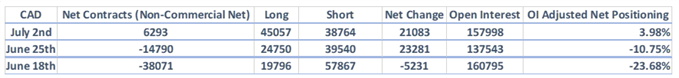

- CAD Longs Surge,Speculators Bullish for First Time Since March 2018

- USD Longs Slashed Yet Again

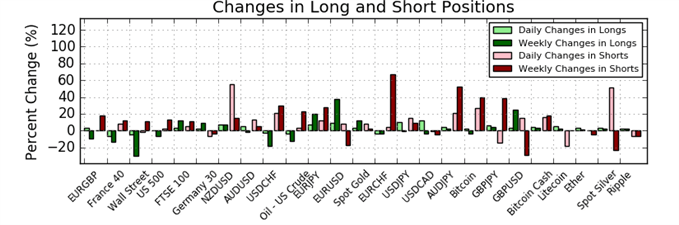

Of note, unfortunately, charts have not yet been updated.

The Predictive Power of the CoT Report

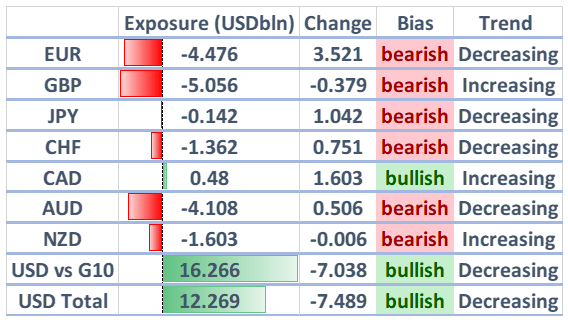

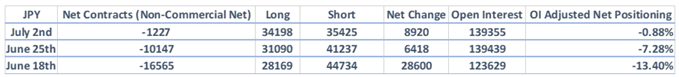

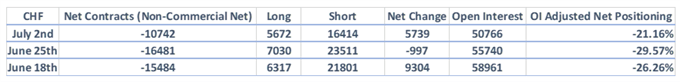

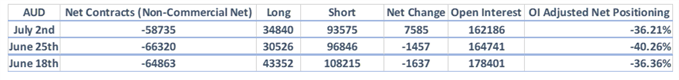

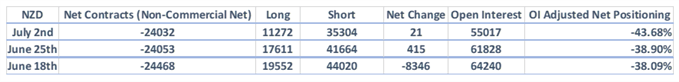

Source: CFTC, DailyFX (Covers up to July 2nd, released July 8th)

GBP Most Bearish Currency, CAD Longs Surge - COT Update

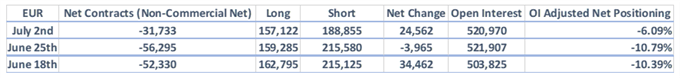

Speculators have continued to slash its bullish positioning in the USD, cutting longs against G10 currencies by $7bln to $16.26bln, marking the lowest level since July 2018. Consequently, Euro shorts were squeezed with net shorts decreasing by $3.5bln to $4.47bln, as such, net positioning adjusted for open interest is now at the lowest since October 2018.

Across commodity currencies, the CADhas flipped to bullish for the first time since March 2018 with gross longs surging to 45k contracts from 25k. This has largely been due to firm Canadian data continues to buoy the currency, which in turn has raised scope for the BoC to maintain a neutral stance and upgrade its economic projections at the upcoming monetary policy decision.

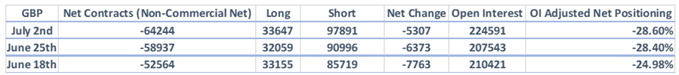

GBPshorts have continued to rise as risks of a no-deal rise, while weak UK data, coupled with an increase in dovish commentary from the BoE has pressured the Pound, which hovers around 2019 lows. Consequently, speculators are the most bearish on the currency since October 2018 with net short contracts equating to $5bln, marking the largest short within the G10 space.

IG CLIENT SENTIMENT (RETAIL POSITIONING): GBPUSD

Data shows 82.5% of traders are net-long with the ratio of traders long to short at 4.73 to 1. In fact, traders have remained net-long since May 06 when GBPUSD traded near 1.29115; price has moved 3.1% lower since then. The number of traders net-long is 3.5% higher than yesterday and 24.9% higher from last week, while the number of traders net-short is 15.4% higher than yesterday and 29.6% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests GBPUSD prices may continue to fall. Positioning is less net-long than yesterday but more net-long from last week. The combination of current sentiment and recent changes gives us a further mixed GBPUSD trading bias.

GBPUSD

KEY TRADING RESOURCES:

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- See our FX forecasts to learn what will drive FX the through the quarter.

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX