COT Report: Analysis and Talking Points

- USD Long Positioning Given Modest Lift

- GBPUSD Sentiment Continues to Deteriorate

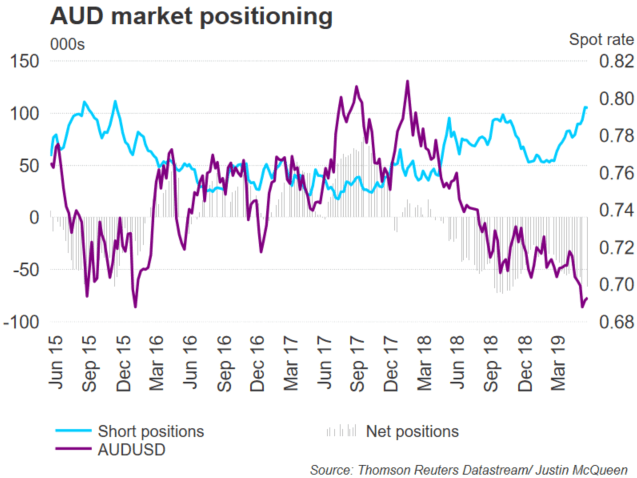

- AUDUSD Sentiment Most Bearish Since 2015

The Predictive Power of the CoT Report

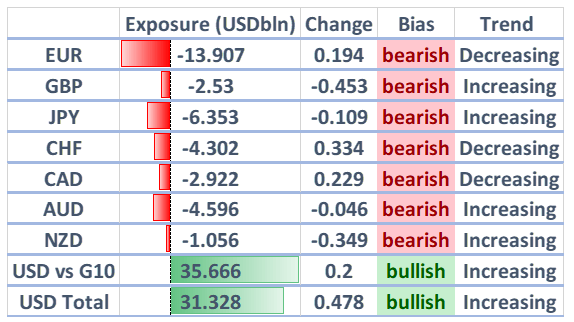

Source: CFTC, DailyFX (Covers up to May 28th, released May 31st)

AUDUSD Bears at 2015 Peak, GBPUSD Shorts Soar – COT Update

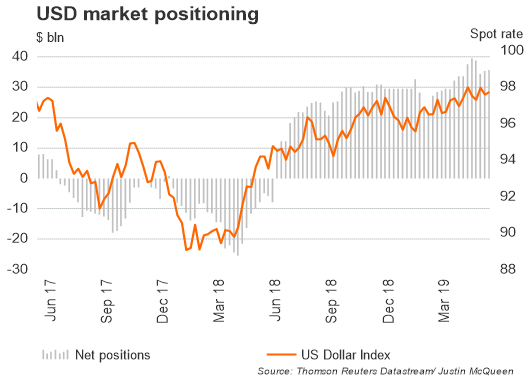

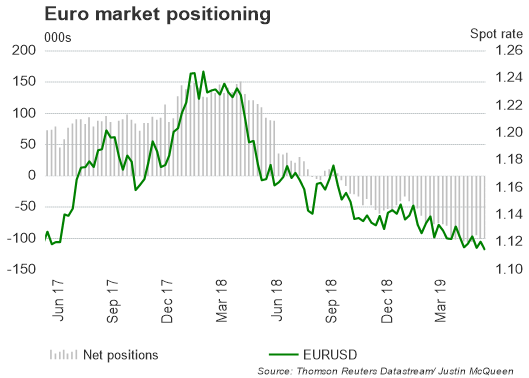

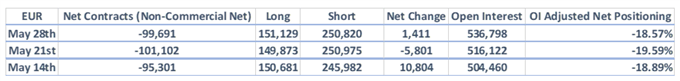

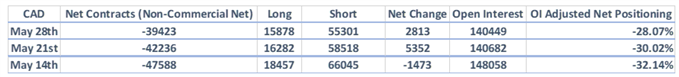

Bullish positioning in the USD saw a marginal uptick ($200mln rise) with net long positioning edging back towards its recent peak vs G10 currencies. The Euro remains the largest net short across the G10 complex with bearish bets at $13.9bln, however, net shorts had been reduced slightly.

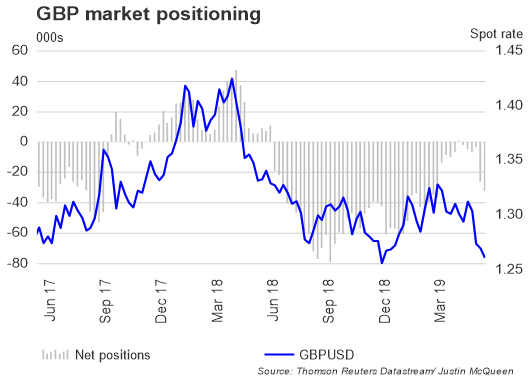

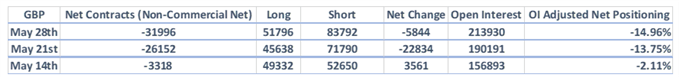

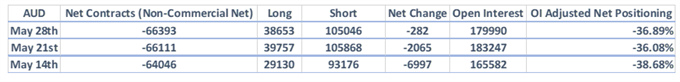

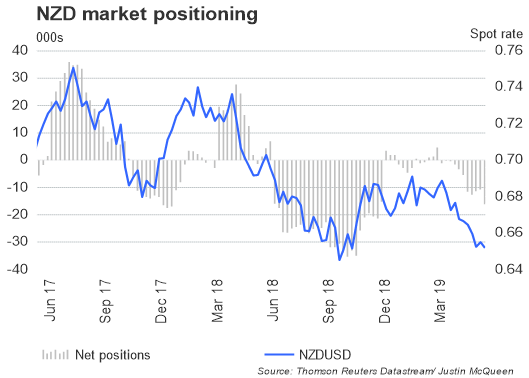

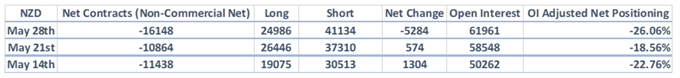

Sentiment in GBP has continued to deteriorate with another sizeable jump in net shorts. Bearish bets now total $2.5bln and is the largest since the beginning of March with gross shorts rising over 30k contracts in the past 2-weeks. Elsewhere, speculators remain very bearish on the Aussie with gross shorts hovering at the largest level since 2015, consequently, this raises the risk of a potential short squeeze.

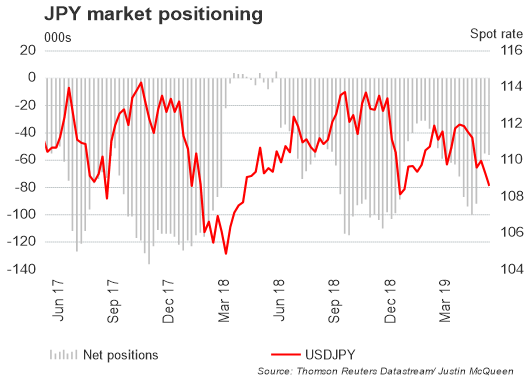

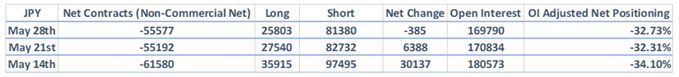

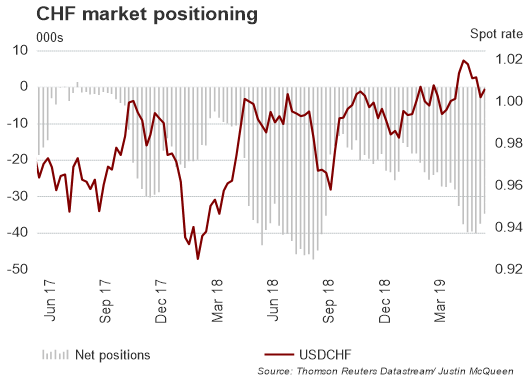

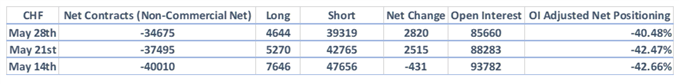

Short positioning in the Swiss Franc continues to look stretched with shorts outnumbering longs by 8.4:1. As such, there is a risk of further short covering in the safe-haven currency, particularly against the backdrop of weakening global activity. Elsewhere, the JPY saw a modest increase in net shorts, which total $6.3bln.

IG CLIENT POSITIONING:

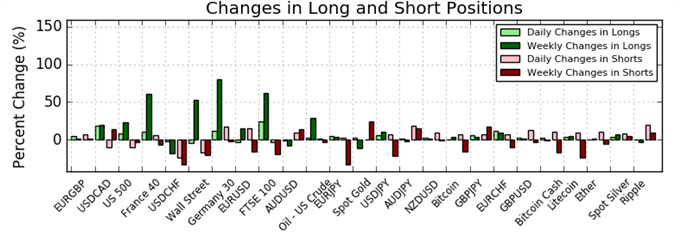

IG client data shows 80.6% of traders are net-long with the ratio of traders long to short at 4.15 to 1. In fact, traders have remained net-long since May 06 when GBPUSD traded near 1.31656; price has moved 3.4% lower since then. The number of traders net-long is 2.8% lower than yesterday and 8.1% higher from last week, while the number of traders net-short is 1.1% higher than yesterday and 4.8% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests GBPUSD prices may continue to fall. Positioning is less net-long than yesterday but more net-long from last week. The combination of current sentiment and recent changes gives us a further mixed GBPUSD trading bias.

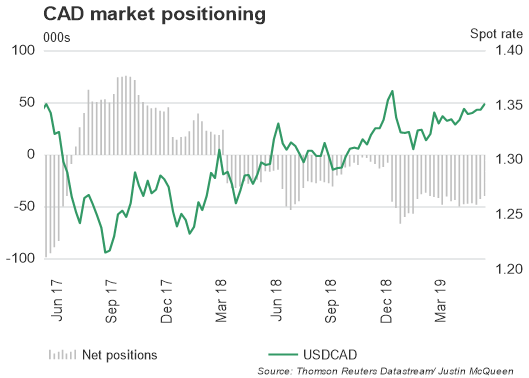

US Dollar

GBPUSD

AUDUSD

KEY TRADING RESOURCES:

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- See our FX forecasts to learn what will drive FX the through the quarter.

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX