COT Report: Analysis and Talking Points

The Predictive Power of the CoT Report

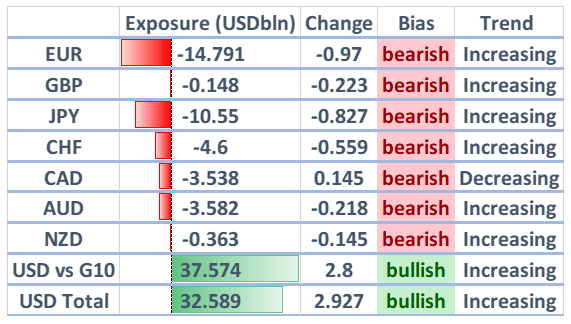

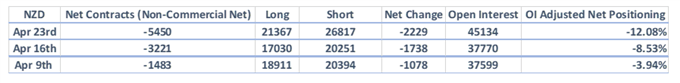

Source: CFTC, DailyFX (Covers up to April 23rd, released April 26th)

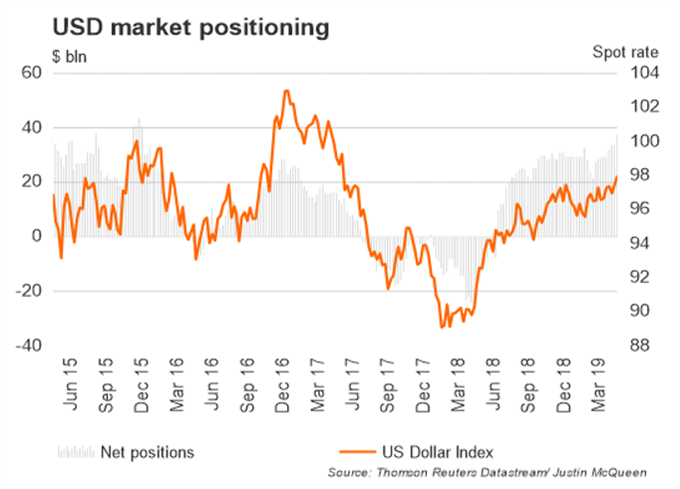

USD Bullish Positioning Extend to Fresh Multi-Year Highs, Euro Shorts Looking Crowded

Speculators yet again increased (+$2.8bln) their net long exposure to the USD, with overall net long positioning at $37.57bln vs. G10 FX. An increase in net short position across the board had attributed to the rise in bullish USD bets, with the exception of the Canadian Dollar.

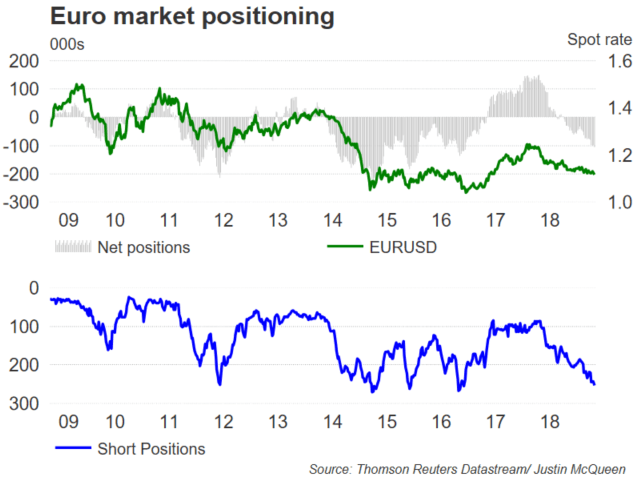

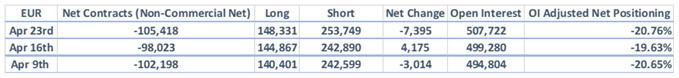

Bearish bets on the Euro continue to make up the bulk of USD longs, however the short positioning on the Euro is beginning to look somewhat crowded, given that gross shorts are now hovering around the peaks seen in 2015 and 2016, which in turn raises the risk of a potential short squeeze. However, with data yet to show a meaningful recovery in the Eurozone, this risk is relatively low for the time being.

- Latest Gross short (254k), 2015 peak (271k), 2016 peak (267k)

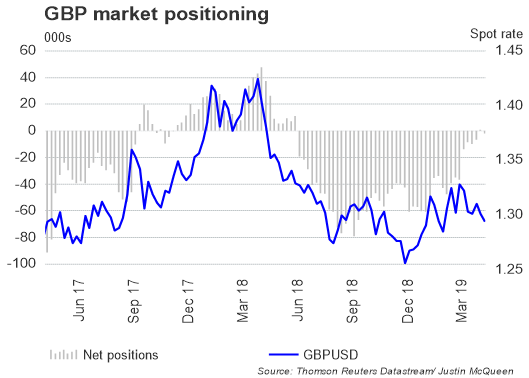

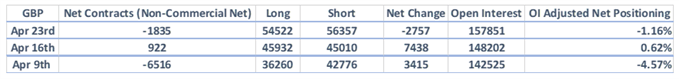

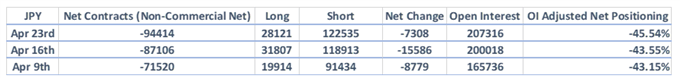

The biggest increase in net short positioning had been seen in the Japanese Yen with net shorts now totaling over $10bln, alongside this, the ratio of speculators that are short to long is at 4.03:1. Elsewhere, GBP net positioning is back to being short, albeit very marginal.

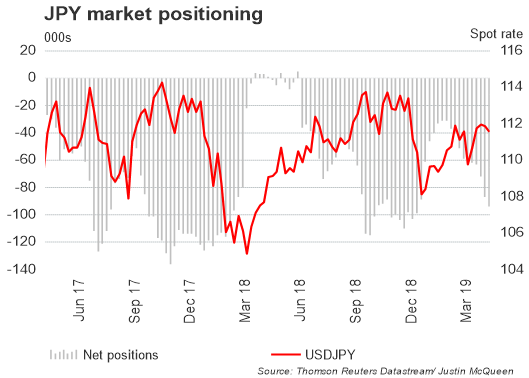

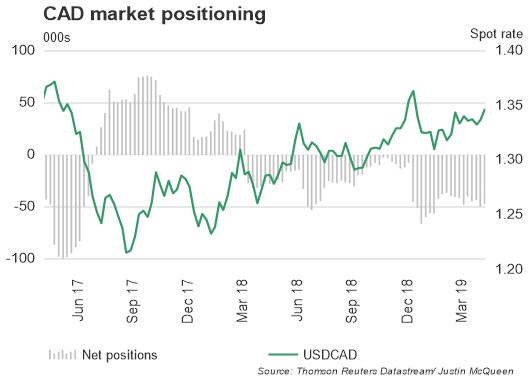

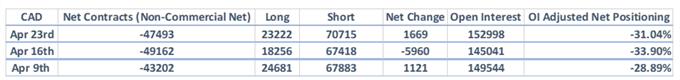

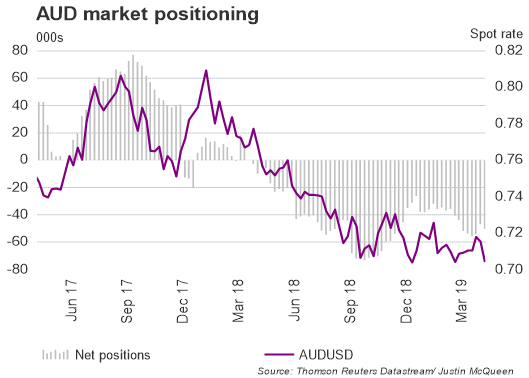

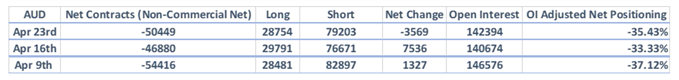

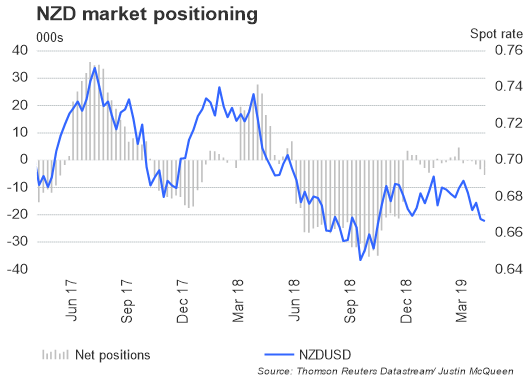

Commodity Currencies (CAD, AUD, NZD): Net short positioning in the New Zealand Dollar is at the highest since December 2018, however, positioning is somewhat modest with net shorts totalling $363mln (AUDNZD longs still attractive). Elsewhere, AUD gross longs saw a slight liquidation, consequently keeping AUD net shorts relatively elevated at $3.5bln, thus keeping the risk/reward favouring upside, particularly after AUDUSD managed to hold above the 0.7000 handle.

US Dollar

AUDUSD

KEY TRADING RESOURCES:

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- See our FX forecasts to learn what will drive FX the through the quarter.

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX