- Yen speculators nearing record short position again

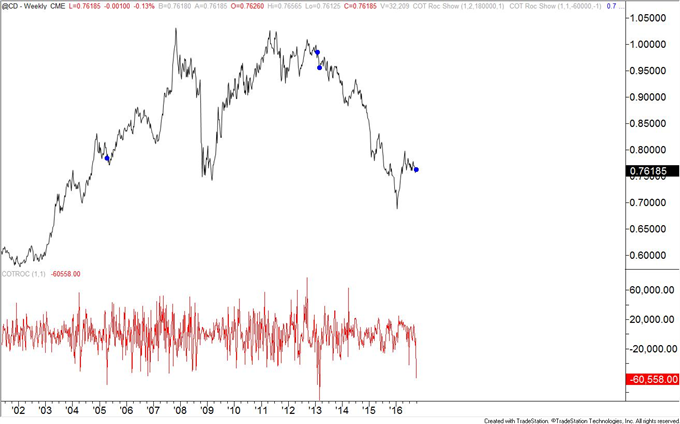

- 4th most 1 week week selling by CAD speculators since at least 2002

- Record ownership profile in MXN abates

For more analysis and trade setups, visit SB Trade Desk

Subscribe to Jamie Saettele's distribution list in order to receive several free reports per week

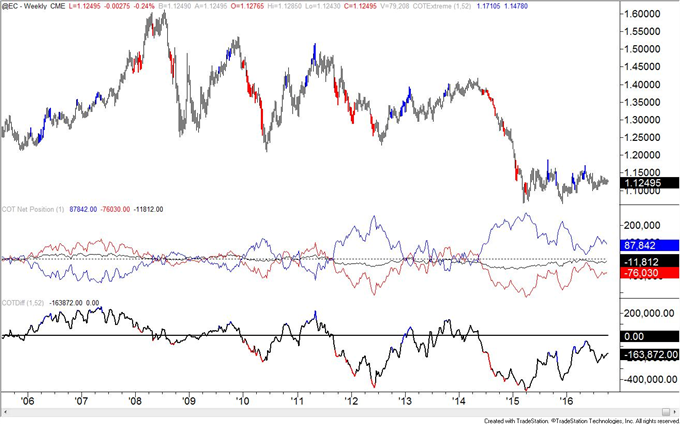

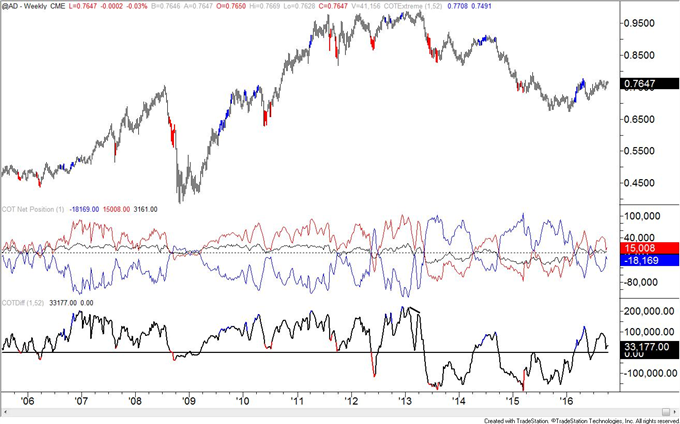

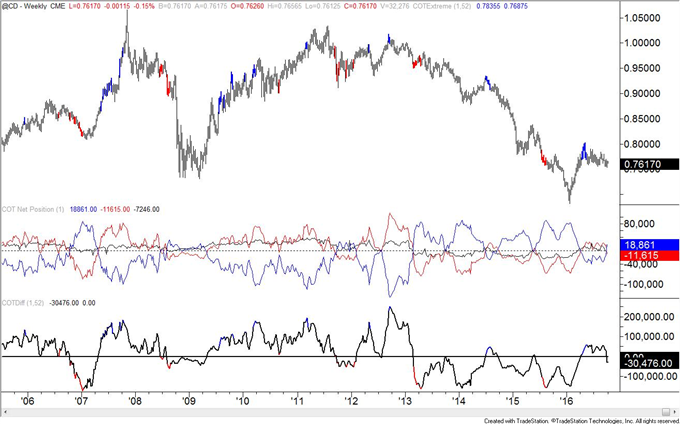

The COT Index is the difference between net speculative positioning and net commercial positioning measured. A blue colored bar indicates that the difference in positioning is the greatest it has been in 52 weeks (bullish) with speculators selling and commercials buying. A red colored bar indicates that the difference in positioning is the greatest it has been in 52 weeks (bearish) with speculators buying and commercials selling. Non-commercials tend to be on the wrong side at the turn and commercials the correct side. Use of the index is covered closely in detail in my book.

Latest CFTC Release dated September 27, 2016

| Week (Data for Tuesdays) | |

|---|---|

| US Dollar | 20 |

| Euro | 59 |

| British Pound | 10 |

| Australian Dollar | 59 |

| Japanese Yen | 94 |

| Canadian Dollar | 47 |

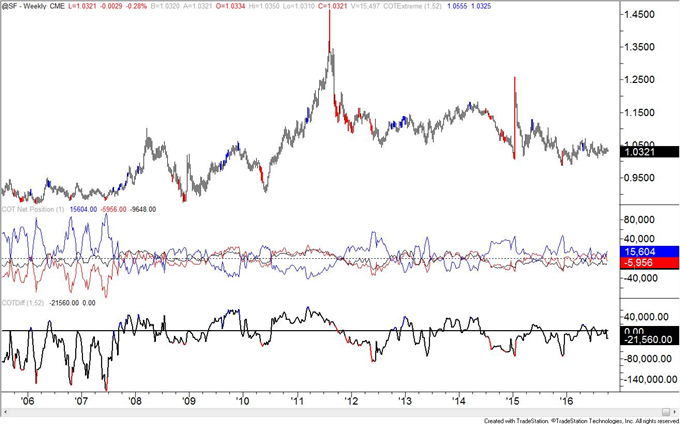

| Swiss Franc | 20 |

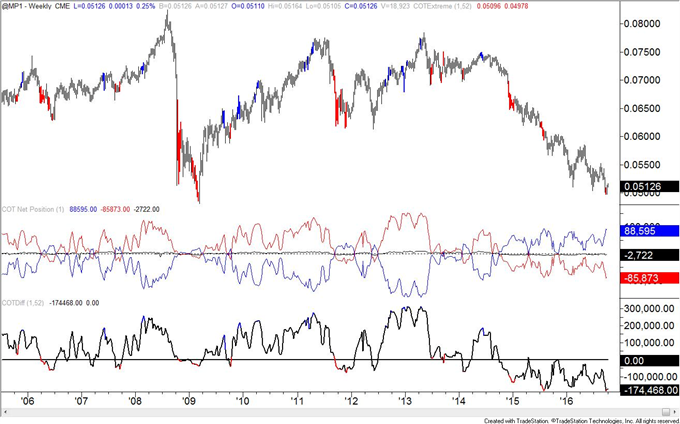

| Mexican Peso | 2 |

| Gold | 88 |

| Silver | 88 |

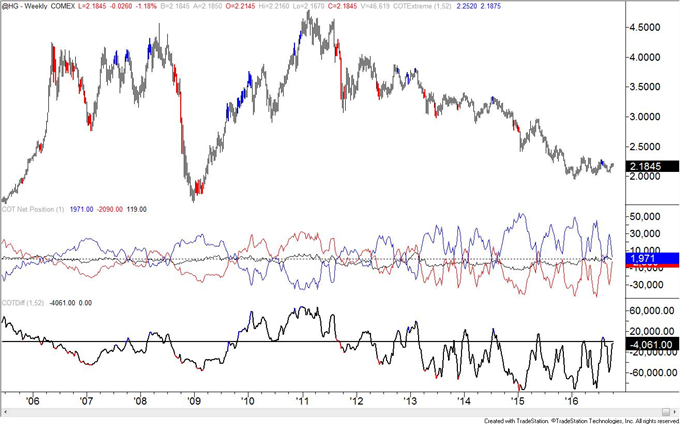

| Copper | 90 |

| Crude | 67 |

Charts (all charts are continuous contract)

Non Commercials (speculators) – Red

Commercials – Blue

Small Speculators – Black

COTDiff (COT Index) – Black

US Dollar ICEUS Continuous Contract

Chart prepared by Jamie Saettele, CMT

Euro CME Continuous Contract

Chart prepared by Jamie Saettele, CMT

British Pound CME Continuous Contract

Chart prepared by Jamie Saettele, CMT

Australian DollarCME Continuous Contract

Chart prepared by Jamie Saettele, CMT

Japanese YenCME Continuous Contract

Chart prepared by Jamie Saettele, CMT

Canadian DollarCME Continuous Contract

Chart prepared by Jamie Saettele, CMT

Canadian DollarCME Continuous Contract

Chart prepared by Jamie Saettele, CMT

The red line below price is the 1 week change in speculative and commercial positioning (net speculative change – net commercial change). An extremely low value indicates heavy speculative selling and heavy commercial buying. This condition warns of downside capitulation in price and therefore a price low. The blue dots indicate weeks when the change in positions was as extreme as now.

Swiss Franc CME Continuous Contract

Chart prepared by Jamie Saettele, CMT

Mexican Peso CME Continuous Contract

Chart prepared by Jamie Saettele, CMT

Gold COMEX Continuous Contract

Chart prepared by Jamie Saettele, CMT

Silver COMEX Continuous Contract

Chart prepared by Jamie Saettele, CMT

Copper COMEX Continuous Contract

Chart prepared by Jamie Saettele, CMT

Crude Oil NYMEX Continuous Contract

Chart prepared by Jamie Saettele, CMT

--- Written by Jamie Saettele, CMT, Senior Technical Strategist for DailyFX.com

To contact Jamie e-mail jsaettele@dailyfx.com. Follow me on Twitter for real time updates @JamieSaettele

Jamie is the author of Sentiment in the Forex Market and co-founder of SB Trade Desk.