GBP/USD - Prices, Charts, and Analysis

- Sterling holding support for now.

- UK PMIs – business activity rises, optimism slips.

Business activity in the UK picked up sharply in March as pandemic restrictions were removed but optimism for the months ahead fell to a 17-month low as the war in Ukraine and economic uncertainty weighed on domestic confidence.

According to Tim Moore, economics director at survey compiler S&P Global, ‘UK economic growth continued to surge higher in March after an Omicron-induced slowdown at the turn of the year. Service sector companies led the way as business activity expanded at the fastest pace since the post-lockdown recovery seen last May. There were widespread reports citing a boost to business and consumer spending from the roll back of pandemic restrictions. Survey respondents commented on stronger demand arising from the return to offices, alongside a resurgence in the travel, leisure and entertainment sectors’.

Mr. Moore added, ‘However, the near-term growth outlook weakened in March, with optimism dropping to its lowest since October 2020 as the war in Ukraine and global inflation concerns took a considerable toll on business sentiment’.

For all market-moving economic data and events, refer to the DailyFX calendar

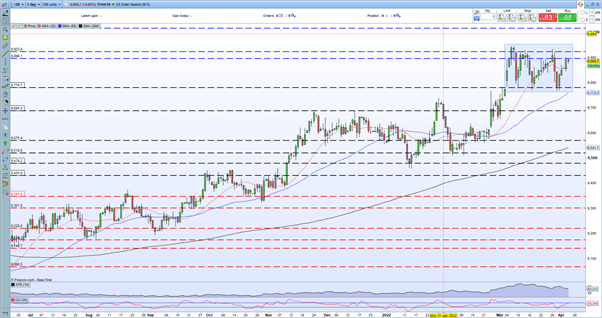

The US dollar remains firm within a multi-week range and is looking to test resistance. The greenback has bounced strongly off support four times in the last month and has now reclaimed the short-dated 20-day sma. If the dollar can keep above here a fresh retest of the 99.74 double-high is likely in the near term.

US Dollar (DXY) Daily Price Chart – April 5, 2022

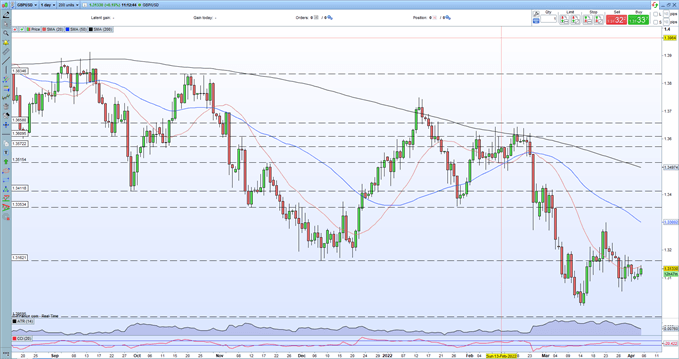

GBP/USD remains pointed lower with a series of lower highs and lower lows prominent since mid-2021. The pair did break higher after testing 1.3000 twice in mid-April and this level may halt, in the short-term at least, any further weakness in the pair. Current price action is minimal as the pair look to re-set before the next move, and this move will likely be driven by the US dollar with little in the way of any Sterling data or speeches out for the rest of the week. Cable remains under the influence of the US dollar in the days ahead.

GBP/USD Daily Price Chart – April 5, 2022

Retail trader data show 69.72% of traders are net-long with the ratio of traders long to short at 2.30 to 1. The number of traders net-long is 0.86% higher than yesterday and 0.56% lower from last week, while the number of traders net-short is 10.82% higher than yesterday and 1.72% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests GBP/USD prices may continue to fall. Yet traders are less net-long than yesterday and compared with last week. Recent changes in sentiment warn that the current GBP/USD price trend may soon reverse higher despite the fact traders remain net-long.

| Change in | Longs | Shorts | OI |

| Daily | 3% | -7% | -3% |

| Weekly | 4% | -10% | -5% |

What is your view on Sterling – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.