USD/JPY Price, Chart, and Analysis

- Bank of Japan keeps monetary policy loose.

- The Yen’s safe-haven status may come under threat.

For a list of all market-moving data releases and events see the DailyFX Economic Calendar

A slow start to the week across a range of financial markets with US markets semi-closed for President’s Day, but risk assets are under pressure after news over the weekend that US President Biden and Russian President Putin will have talks this week over the Russia/Ukraine crisis. Markets have taken this as a positive sign, with risk assets picking up a bid, but these bids may be short-lived, especially with the amount of news/fake news swirling around the market of late.

The Japanese Yen weakened last week against a range of other currencies after the Bank of Japan kept monetary policy loose when the central bank reiterated that it would continue to buy 10-year JGBs to achieve its 2% inflation target. While other central banks are actively stopping and looking to reverse their pandemic bond-buying programs, the Bank of Japan remains on the bid for 10-year JGBs to defend its yield target. If the political premium is removed from the Yen, the USD/JPY could move turn around and move higher.

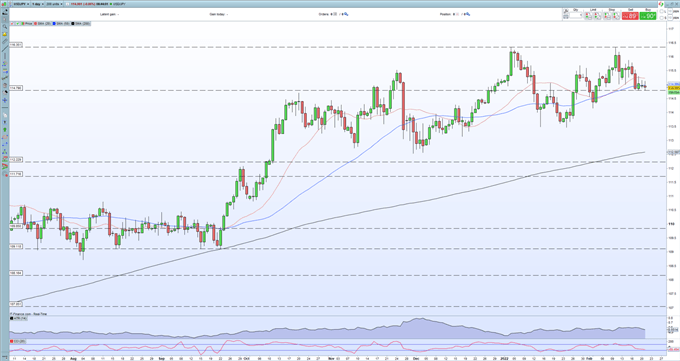

The daily chart shows the multi-month trend higher remains in place, propped up by a series of higher lows. This is in contrast to price action over the last 7-10 days which has produced a short-term series of lower highs. The pair are very close to initial support around 114.80, although this doesn’t look the strongest of support levels before 114.13 and 113.48 come into play. A continuation of the bullish move would see last week’s prior highs act as minor resistance levels all the way back up to 116.34. The CCI indicator suggests that the pair are becoming oversold.

Trade Smarter - Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

USD/JPY Daily Price Chart February 21, 2022

| Change in | Longs | Shorts | OI |

| Daily | 0% | -1% | -1% |

| Weekly | 14% | 3% | 5% |

What is your view on the USD/JPY – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.