S&P 500, US Economic Data, Central Bank Policy, Inflation– Talking Points

- S&P 500 gains by just 0.06% as markets rebound from Wednesday’s decline

- Materials sector buoyed by strength amongst metals prices

- Mega-cap tech supports indices, consumer sentiment data eyed

The S&P 500 rebounded slightly on Thursday after hot inflation data on Wednesday saw equities give up recent gains. Tech stocks rose as semiconductor names rebounded sharply, followed by materials names. Materials were buoyed by higher metals prices, which are often seen as a hedge against rising inflation. Seven of the eleven sectors of the S&P 500 were positive on Thursday. Despite WTI prices falling slightly, the energy sector was one of the session’s strongest performers.

The broader market was also supported by gains across mega-cap tech, with Apple, Amazon, and Google all posting positive sessions. Despite the slight rebound, market participants may continue to worry about elevated inflation. Bond markets were closed on Thursday due to Veteran’s Day which left rates unchanged for the session, allowing equities to plot their own course.

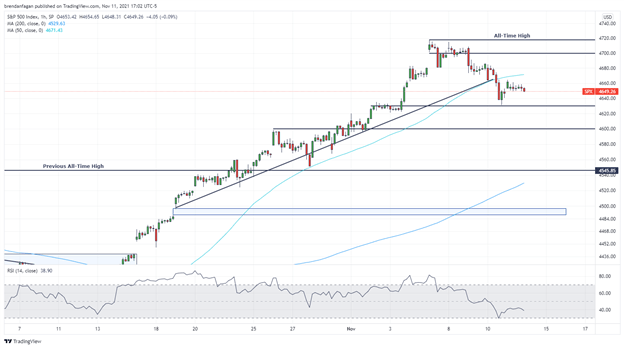

S&P 500 1 Hour Chart

Chart created with Trading View

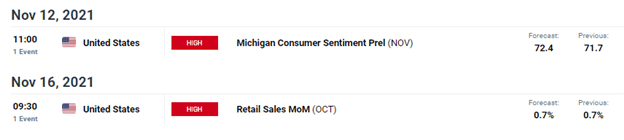

Although inflation data is in the rearview mirror, market participants may continue to look to economic data for near-term direction. Friday sees the release of a preliminary reading on consumer sentiment, with retail sales data following next week. The health and sentiment of the American consumer may help paint a clearer picture when it comes to Fed policy, particularly when the U.S. central bank may look to begin tightening. Central banks around the world have already begun the tightening process, with Mexico hiking rates on Thursday by 0.25%. While much of the policy action has been contained to emerging markets, various countries are beginning to act on rampant inflation. Whether the U.S. and other major developed markets follow suit in the near-term is yet to be seen. A continuance of elevated inflation in the U.S. may weigh on equity valuations as market bets on rate hikes get pulled forward.

US Economic Calendar

Courtesy of the DailyFX Economic Calendar

Resources for Forex Traders

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

--- Written by Brendan Fagan, Intern

To contact Brendan, use the comments section below or @BrendanFaganFX on Twitter