GBP/USD Analysis & News

- Eyes on BoE Speeches in light of Aggressive Hawkish Bets

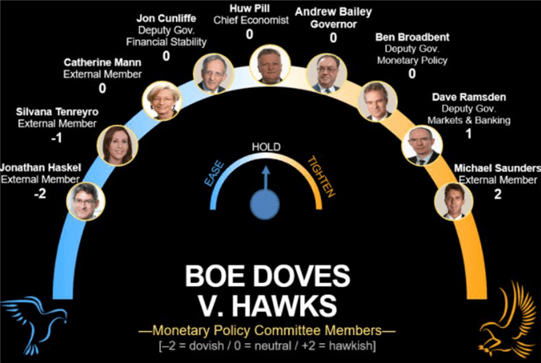

- Tenreyro & Mann Typically Dovish Leaning

The main highlight for GBP traders will be on the upcoming speeches from BoE Officials given the aggressive tightening priced into UK rates. While the rates market appears pretty conclusive that the BoE will tighten policy this year, it is still an open debate as to whether the Bank will pull the trigger with traders yet to hear from the more dovish members on the committee. The weekend commentary below highlighted that some officials are growing more concerned over the spike in inflation.

- Governor Bailey: Concerned that inflation is above target. Have to prevent inflation expectations from becoming embedded. We have some big and unwanted price changes.

- BoE's Saunders (Most Hawkish): Market pricing in an earlier rise in Bank rate is appropriate. Markets had fully priced in a February rate hike and half-priced in December. Additionally, widespread labour shortages pose a bigger risk of inflation by feeding into higher pay demands. (What had been interesting by Saunders had been that the rate setter implied the first move could be 25bps as opposed to 15bps)

This morning, initial comments from the typically dovish Tenreyro, leaned on the more cautious side with the rate-setter stating that raising interest rates to counter-one off price rises would be self-defeating, while also reiterating that inflation should be transitory. Surprisingly, these comments which are not exactly an endorsement for raising rates imminently has been largely shrugged off by the Pound. That being said, we can expect to hear from BoE’s Mann from 15:40BST, another official who leans slightly on the more cautious side. Therefore, should we see a pushback against recent market pricing, the Pound will likely see a pullback from recent highs.

BoE Hawk/Dove Meter

Source: Bloomberg

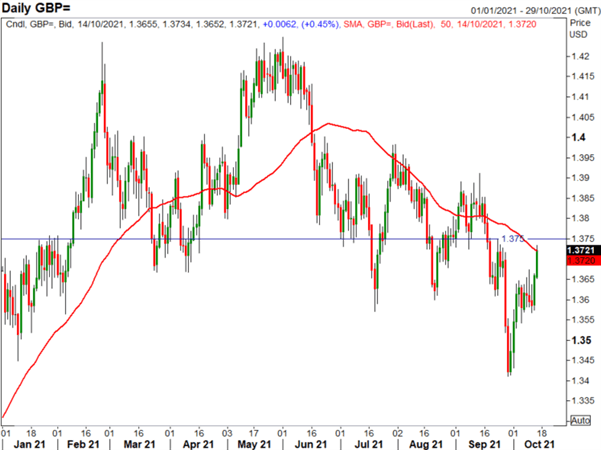

GBP/USD: Good two-way price action in cable as the morning lift above 1.37 pares slightly. Still, topside resistance at 137.50 will be the focus for bulls. Meanwhile, the dip in EUR/GBP falls short of printing fresh YTD lows, however, the path of least resistance appears lower with a close below 0.8450 to confirm as much.

GBP/USD Price Chart: Daily Time Frame

Source: Refinitiv