Key Talking Points:

- Global stocks drag along as economic uncertainties pile up

- Economic conditions and sentiment worsen in Germany as stagflation fears increase

Global stocks continue to struggle for direction as many questions remain in the backs of investors’ minds. Will inflation pressures start to cool off? Will soaring energy prices hinder economic recovery? Will central banks stick to loose monetary policy or will they be tempted to start tightening the supply of money? European indices have opened lower for the third day in a row with US futures pointing in the same direction.

These uncertainties have kept equities from pushing above the September highs as they seesaw with a bearish trend. Increasing inflation concerns have dampened sentiment ahead of the US CPI data release tomorrow, which will be a key data point in investors’ minds to gauge the short-term impact of inflation, especially now that stagflation fears are back on the table. On top of that, earnings season gets underway this week and we might start to see what has happened to corporate profits and margins in the face of the recent rise in prices, and what this may mean for growth in the 4th quarter.

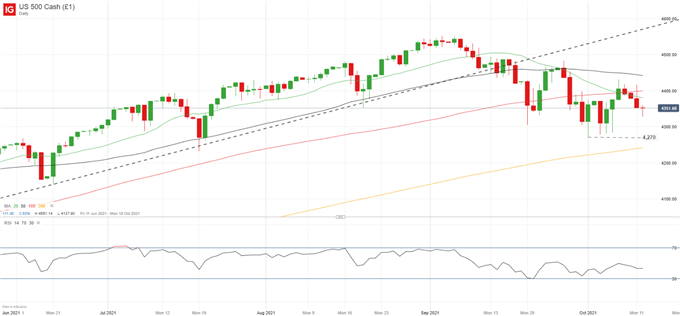

The S&P 500, usually regarded as one of the best indicators of overall market sentiment, continues to push away from the monthly highs seen last Thursday, looking vulnerable to another drop towards the lows seen on October 1st (4,270). Both the RSI and the moving averages are pointing towards further losses in the short term, which would risk buyers losing control of the long-term bullish trend.

S&P 500 Daily Chart

DAX 40 | ZEW CONFIRMS WORSENING SENTIMENT

In Germany, the DAX 40 is feeling the effects of rising bund yields as inflation expectations increase within the Eurozone, bringing forwards the odds of a rate hike from the ECB to December 2022. The latest ZEW data is showing worsening sentiment amongst stock market professionals, with both current conditions and sentiment coming in below forecasts, which plays in line with concerns about growth and inflation in the short term.

Technically, the outlook is also worsening as showcased by weakening momentum indicators. That said, support seems to be pretty strong at the moment between 14,815 and 15,000 so we may see further sideways trading as momentum consolidates further. The prospects of another test of the descending trendline resistance seem pretty slim in the short-term, with the area around 15,300 a tougher level to crack for now.

DAX 40 Daily Chart

Learn more about the stock market basics here or download our free trading guides.

--- Written by Daniela Sabin Hathorn, Market Analyst

Follow Daniela on Twitter @HathornSabin