EUR/USD Price, Chart, and Analysis

- PEPP to be replaced by a new, flexible, bond-buying program.

- Friday’s US Jobs Report (NFP) will be the next driver of EUR/USD

Keep up to date with all market-moving data releases and events by using the DailyFX Calendar

The ECB is likely to announce a new bond-buying program when the outstanding Pandemic Emergency Purchase Program (PEPP) is completed in Match, according to market sources. While PEPP was always expected to be replaced by new liquidity measures, the talk is that the new program will have more capital key flexibility. The capital key is used to decide the amount/proportion of bonds that the ECB can buy from each country. A flexible capital key will allow the central bank to be adaptable when buying bonds. The source story also says that the new program will be used to prevent government bond spreads from widening, keeping borrowing costs down. The new capital key flexibility will give the central bank this option.

Trade Smarter - Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Friday’s US Jobs Report (NFP) is now seen as the driver of the next move in EUR/USD as the market waits to see if the Fed is ready to announce a formal timetable for paring back their QE program. The market expects and has priced-in, that the Fed will begin tapering in November and finish bond-buying in mid-2022. These expectations have continued to press EUR/USD lower and the one worry for Friday’s release is if the Fed delay any taper announcement, a dovish outcome, a situation that would send the US dollar lower and see EUR/USD push higher.

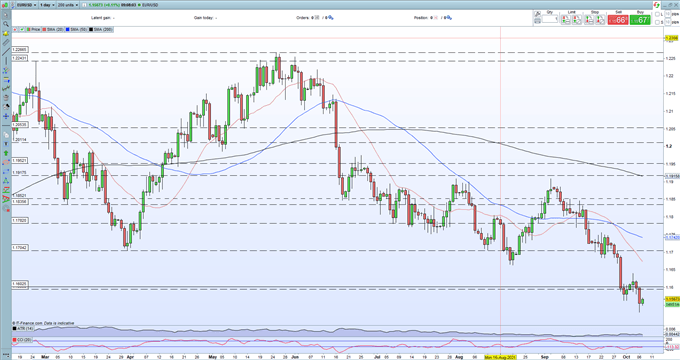

Euro (EUR/USD) Daily Price Chart October 7, 2021

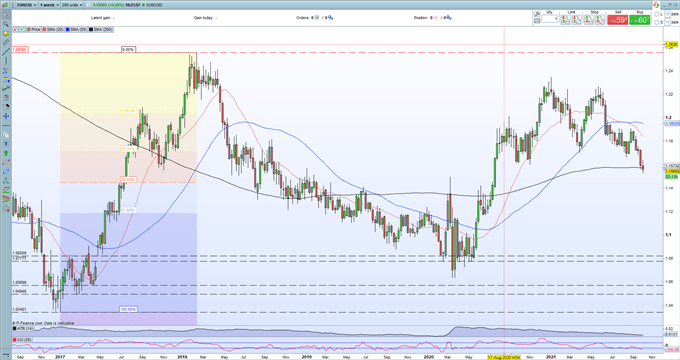

If we look at the weekly EUR/USD chart we can see that the pair is basically stuck in the middle of a 22 point range created between January 2017 (1.03401) and February 2018 (1.2556). The pair sit on the longer-dated moving average and are close to the 50% Fibonacci Retracement level around 1.1450. While there may be further downside for the pair, it looks likely to be a long, slow grind.

Euro (EUR/USD) Weekly Price Chart October 7, 2021

Retail trader data show 63.72% of traders are net-long with the ratio of traders long to short at 1.76 to 1. The number of traders net-long is 2.84% lower than yesterday and 5.51% lower from last week, while the number of traders net-short is 4.79% higher than yesterday and 30.04% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests EUR/USD prices may continue to fall.Yet traders are less net-long than yesterday and compared with last week. Recent changes in sentiment warn that the current EUR/USD price trend may soon reverse higher despite the fact traders remain net-long.

| Change in | Longs | Shorts | OI |

| Daily | -1% | -4% | -3% |

| Weekly | 4% | -10% | -5% |

What is your view on EUR/USD – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.