US Dollar Analysis & News

ISM Headline Beats, Employment Index Contracts

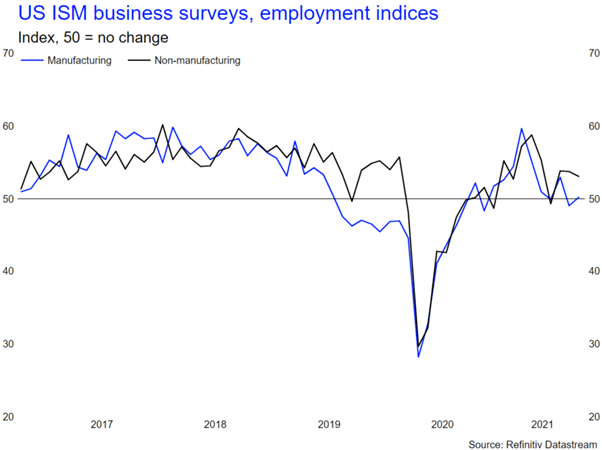

US ISM Non-Manufacturing PMI for September rose to 61.9, beating expectations of 60. Meanwhile, the sub-components were on the whole firmer across the board with the new orders index rising to 63.5 from 63.2, prices paid ticked higher with a move to 77.5 vs 75.4 previously. However, among the main sub-component in terms of market focus, the employment index, did fall slightly to 53 from 53.7. Although, Friday’s ISM Manufacturing employment index did move back into expansionary territory and thus providing a slightly mixed signal for this week’s NFP report.

How Non Farm Payrolls Drives the US Dollar

ISM Employment Indices Providing Mixed Signal for This Week’s NFP Release

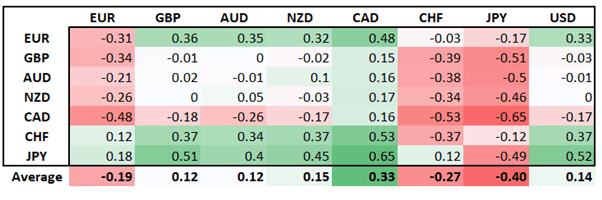

USD/JPY Picks Up as JPY Suffers Across the Board

In reaction to the report, alongside the move higher in breakevens, the USD is back above the 94.00 handle, while the bulk of the move has been seen against the Japanese Yen, which is suffering from not only the move higher in the greenback but also equities perking up. In turn, the pair is back at short term resistance at 111.50-60.

DailyFX Calendar

Source: DailyFX

Trade Smarter - Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team