HOW NONFARM PAYROLLS (NFP) IMPACTS THE US DOLLAR & USD PRICE VOLATILITY

- The US Dollar typically exhibits heightened volatility around the monthly release of nonfarm payrolls data and places USD price action at risk of experiencing outsized moves

- Realized volatility in the US Dollar Index and its major currency pairs around NFP reports tends to run above-average as forex traders reassess the US economy and jobs market

- Read more on Trading the NFP Report or check out this insight on the Federal Reserve for details on how nonfarm payrolls data can impact FOMC interest rate decisions

Currency volatility, which is characterized by the frequency and magnitude of changes in a currency’s value, tends to rise during times of heightened market uncertainty. The release of high-impact economic data – like US nonfarm payrolls (NFP) – have historically served as a key source of heightened market activity.

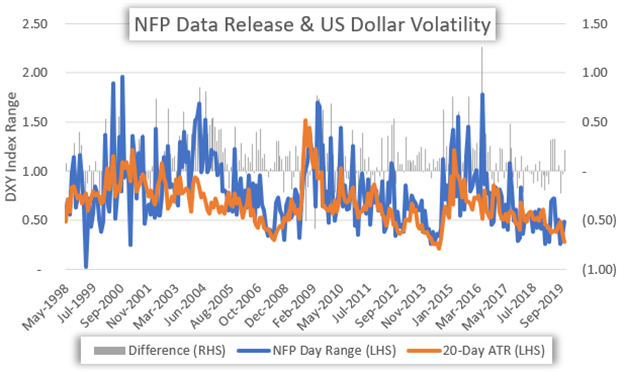

US DOLLAR VOLATILITY TYPICALLY ELEVATED IN RESPONSE TO THE MONTHLY NFP REPORT (CHART 1)

Referred to less formally as the US jobs report, nonfarm payrolls data is released at 8:30 AM EST on the first Friday of each month by the Bureau of Labor Statistics (BLS). Regularly published NFP figures provide market participants with a detailed summary of the US employment situation and broader labor market conditions.

As such, traders tend to place heavy weight on the monthly US NFP report. This is seeing that the closely watched employment data has serious potential to sway future monetary policy decisions by the Federal Reserve (Fed) given the central bank’s stated dual-mandate of price stability and full employment.

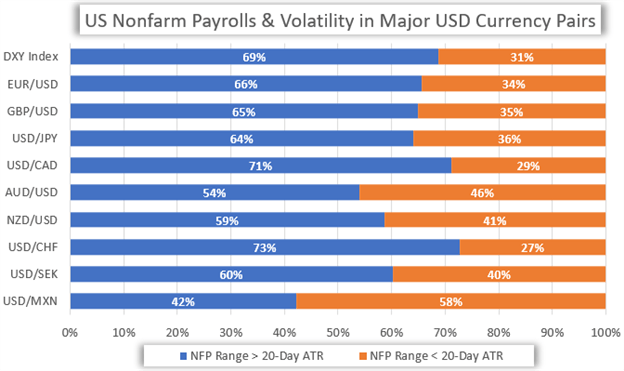

NONFARM PAYROLLS DATA TENDS TO PROMPT VOLATILITY IN THE US DOLLAR AND MAJOR USD CURRENCY PAIRS (CHART 2)

In fact, the daily trading range on the US Dollar Index (DXY) exceeds its typical trading activity over the preceding month (i.e. 20-day ATR) more often than not on nonfarm payrolls day. Differences between NFP data actually reported and market expectations (i.e. NFP surprise) prior to the report publication serves as the underlying catalyst that facilitates the larger swings in USD price action.

On that note, volatility in the US Dollar roughly mirrors the NFP surprise magnitude. This means the greater the difference between actual results and forecast estimates (in absolute value terms), the more likely the DXY Index and its components will experience heightened measures of volatility.

For example, when the NFP surprise is above 35.0K jobs or below -55.0K jobs (i.e. the top and bottom distribution quartiles of observations since June 1998), the DXY Index’s daily trading range exceeds its respective 20-day ATR 69% of the time.

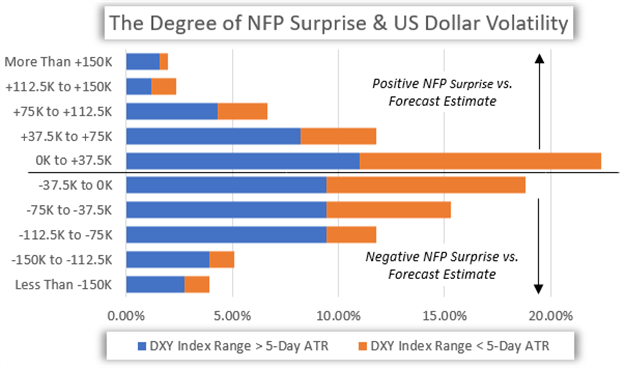

US DOLLAR VOLATILITY & MONTHLY CHANGE IN NONFARM PAYROLLS SURPRISE DISTRIBUTION (CHART 3)

However, US Dollar volatility is less prominent when the headline change in nonfarm payrolls figure falls roughly in-line with the market estimate. That said, actual NFP figures have crossed the wires within a +/- 37.5K band of the median forecast 41.2% of the time dating back to June 1998. Likewise, the headline nonfarm payrolls number has historically fallen within +/- 75.0K of the market forecast 68.2% of the time.

As would be expected, intraday swings in the US Dollar grow increasingly volatile – particularly with respect to its 5-day ATR – as the degree of NFP surprises expands. Specifically, the daily range on the DXY Index surpasses its 5-day ATR 20.4% of the time when the NFP surprise is between -37.5K and +37.5K jobs but exceeds its 5-day ATR 38.0% of the time given a +/- 75.0K surprise band.

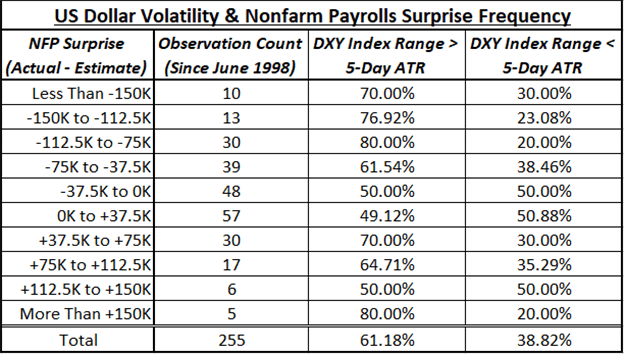

US DOLLAR VOLATILITY & NFP SURPRISE DISTRIBUTION FREQUENCY (CHART 4)

Furthermore, the intraday range recorded by the US Dollar Index when nonfarm payrolls data is released exceeds its respective 5-day ATR 61.18% of the time on balance according to historical data since June 1998.

Similarly, out of the 30 observations that nonfarm payrolls missed estimates by -75.0K to -112.5K over the sample period, the intraday range printed by the DXY Index exceeded its 5-day ATR 80% of the time. This further underscores the high probability that USD price action will experience above-average episodes of volatility in response to the monthly US jobs report.

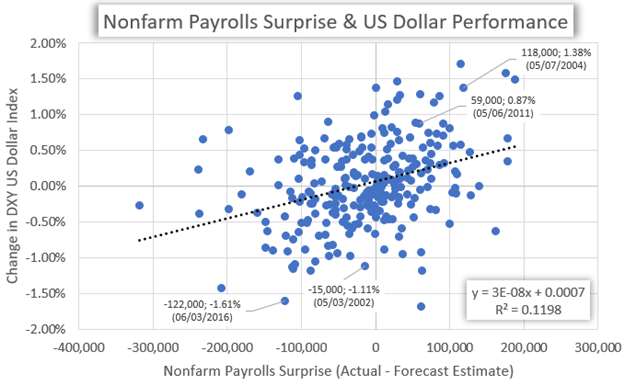

US DOLLAR PERFORMANCE & DEGREE OF NONFARM PAYROLLS SURPRISE (CHART 5)

As one might expect, there is a roughly positive relationship between the directional surprises in NFP data and the US Dollar. Although it might not always be the case, a better-than-expected reading on nonfarm payrolls is normally associated with higher spot USD prices (and vise-versa). At the same time, performance in the Greenback roughly mirrors the NFP surprise magnitude.

For instance, the DXY Index notched a -1.61% decline on June 03, 2016 after the -122K surprise miss revealed in the period’s NFP report, but the US Dollar recorded a more palatable -1.11% drop when nonfarm payrolls data reported on May 03, 2002 missed estimates by a less disappointing -15K jobs.

On the other hand, the May 06, 2011 NFP report beat expectations by +59K jobs and saw the US Dollar rise by 0.87% in response while the May 07, 2004 release surprised by +118K and drove the DXY Index 1.38% higher.

FOREX TRADING RESOURCES

- Download our free Trading Guides and Forecasts for comprehensive insight on major currencies like the US Dollar and Euro in addition to equities, gold and oil

- Sign up for Live Webinar Coverage of the financial markets hosted by DailyFX analysts where you can have all your trading questions answered in real-time

- Find out how IG Client Sentiment data can be used to identify potential forex trading opportunities

-- Written by Rich Dvorak, Junior Analyst for DailyFX.com

Connect with @RichDvorakFX on Twitter for real-time market insight