Key Talking Points:

- Fed officials stick to hawkish rhetoric as taper talks intensify

- XAU/USD continues to trade within key Fibonacci levels

Gold (XAU/USD) is attempting to make a recovery from monthly lows after a hawkish tilt from the Federal Reserve left the precious metal struggling for direction. The current monetary policy was left unchanged as widely expected, even before the risks of Evergrande’s collapse, but Powell and co. stuck to their taper agenda by suggesting that it make come as soon as November if progress continues broadly as expected, although, in typical central bank fashion, they didn’t commit to a specific date.

Another slight change was the dot-plot projections from the last ones published in June, which show that there is an even split between those who think rates will be lifted at the end of 2022 and those who think the first hike will come in early 2023. They also revised higher the inflation expectations for the next three years, as well as real GDP growth in 2022 and 2023.

On average, these changes reflect expectations of a gradual recovery to take place over the next three years rather than a continued recovery for the next 12 to 18 months. The press conference also suggested that the Fed may have been just a vote or two shy from starting tapering at this meeting, which is a more hawkish stance than many were anticipating.

Based on this, the outlook for gold over the next few weeks is slightly dull. The need to invest in gold will diminish as rates rise given how investors will be able to generate a higher return elsewhere, not that XAU/USD has been capable of taking advantage of the recent low-rate environment anyway. Moreover, with the US Dollar picking up, bullion will be less appealing for those holding other currencies. So, all in all, the fundamental picture for gold is not looking too bright.

The only silver lining we may see over the next few days is the unfolding of the Evergrande situation, although the immediate fear and rush to safety seem to have diminished with the injection of 120 billion yuan by the PBOC, a sign that the central bank is looking to clean up the mess slightly. But with two offshore bond payments due to be made on Thursday, and others to follow, we may still have a few days of risk-off sentiment left in markets, which would likely keep XAU/USD supported in the short term.

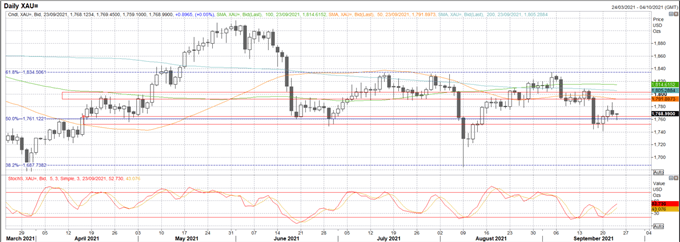

XAU/USD Daily chart

Chart prepared by Daniela on Refinitiv

The current trend in XAU/USD seems positive after bouncing off its long-term area of support (1,752 – 1,763) but gold is likely to struggle to find bullish momentum whilst below 1,790, where the 50-day SMA is converging. A break above this area would place buyers in a good position to try and tackle 1,800, at which point resistance is likely to be met on the way up to the 61.8% Fibonacci at 1,834.

XAU/USD Monthly chart

The monthly chart is showing worsening conditions although the majority of the trading has been kept confined within its key Fibonacci levels. The RSI remains in bullish territory but is tilted to the downside as it heads for the middle of the range, a sign that further bearishness may arise.

Fibonacci Confluence on FX Pairs

Learn more about the stock market basics here or download our free trading guides.

Traders of all levels and abilities will find something to help them make more informed decisions in the new and improved DailyFX Trading Education Centre

--- Written by Daniela Sabin Hathorn, Market Analyst

Follow Daniela on Twitter @HathornSabin