RAND ANALYSIS

- Evergrande contagion concerns hurt ZAR.

- Taper directives a possibility later this week.

- USD/ZAR bulls eye 15.0000.

ZAR FUNDAMENTAL BACKDROP

GET YOUR Q3 RAND FORECAST HERE!

RAND LINKED COMMODITIES HIT HARD

The South African rand has continued its depreciation against the U.S. dollar this week after the Evergrande default probability remains. Interest payments are due on Thursday (23 September) for the real estate giants March 2022 bond amounting to $83.5 million. Should Evergrande fail to do so, the bond will default if payment is not made within 30 days of the planned payment date.

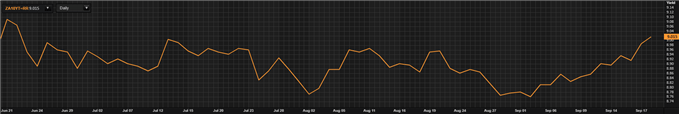

South African 10-year government bond yields have spiked (see chart below) due to investors seeking safe-haven assets contributing to a decline in price action for the local currency.

Source: Refinitiv

Iron ore, one of South Africa’s primary exports has been significantly shaped by the Evergrande situation with China being a major trade partner. Platinum is following suit trading lower at the open exacerbated by a stronger dollar.

BOTH U.S. AND SOUTH AFRICAN CENTRAL BANKS SCHEDULED TO MEET LATER THIS WEEK

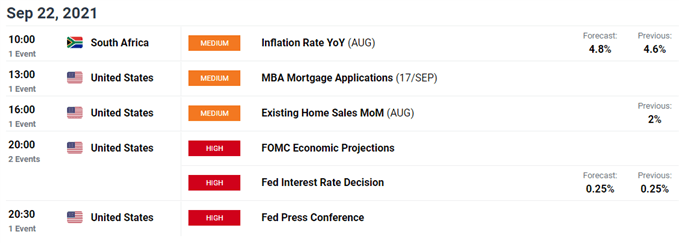

The strong dollar may gain further traction should the Federal Reserve decide to introduce a reduction in asset purchases.

Source: DailyFX economic calendar

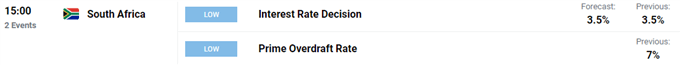

South African inflation (CPI) features on Wednesday and could serve as an influencing factor to the South African Reserve Bank (SARB) monetary policy meeting on Thursday.

Source: DailyFX economic calendar

TECHNICAL ANALYSIS

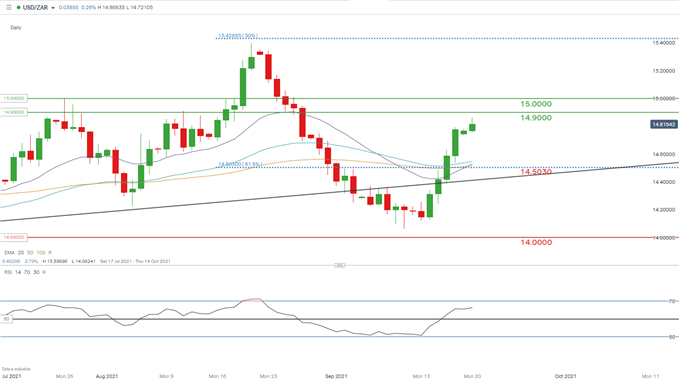

USD/ZAR DAILY CHART

Chart prepared by Warren Venketas, IG

The daily USD/ZAR chart reflects the exponential rise in the pair as today’s candle is likely to close in the green for the sixth consecutive day. on the Relative Strength Index (RSI) is well above the midpoint 50 level indicative of strong bullish momentum, and still has room to the upside. The recent bullish crossover signaled by the Exponential Moving Average (EMA) – 20-day crossing above 100-day. This signal may convert into a 20/50-day cross thus giving added bullish impetus to the pair.

Resistance levels:

- 15.0000

- 14.9000

Support levels:

- 14.5030 - 61.8% Fibonacci level

Trade Smarter - Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

--- Written by Warren Venketas for DailyFX.com

Contact and follow Warren on Twitter: @WVenketas