Euro (EUR/USD) Price, Chart, and Analysis

- EUR/USD rally helped by a weaker US dollar.

- US GDP and inflation releases are now key for the greenback.

The US dollar continues to fade lower post-FOMC, touching monthly support just below 92.00. The multi-week channel was broken decisively earlier this week and yesterday’s Fed decision and chair Jerome Powell’s press conference gave away little to help support the greenback. Chair Powell noted that the Committee had reviewed ‘some considerations around how our asset purchases might be adjusted, including their pace and composition, once economic conditions warrant a change’. Powell added that the timing of any changes to the asset purchase program ‘will depend on incoming data’ and today and tomorrow bring two heavyweight releases that will give the Fed more light on the current health of the US economy.

Today at 13:30 BST, the first look at US Q2 GDP will be released, with the quarter-on-quarter rate expected to increase to 8.5% from a prior 6.4%, while on Friday the Fed’s favored measure of inflation, core PCE, is expected to show inflation rising to 3.7% from a prior 3.4% on a year-on-year basis. These two data releases will decide the short-term direction of the US dollar and most USD-pairs.

Today’s German unemployment data beat market expectations with unemployment falling by more than expected, -91k vs. expectations of -28k, bring the unemployment rate in July down to 5.7% against expectations of 5.8% and a prior month’s 5.9%. Preliminary German State inflation data also suggest that the Eurozone’s largest member will report a surge in inflation to around 3.3% in July, compared to 2.3% in June. While this would be a strong reading, the rise in price pressure is expected to be temporary and likely to subside over the coming months.

For all market-moving economic data and events, see the DailyFX Calendar.

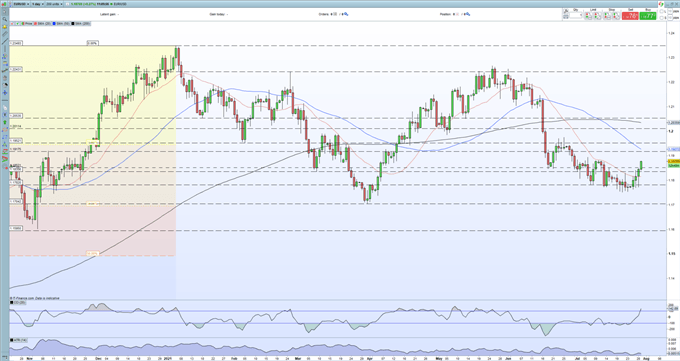

The latest EUR/USD chart shows the pair nearing a zone of resistance between 1.1883 all the way up to 1.1975. While upcoming data releases may help the pair challenge the higher level, it may take some exceptional beats/misses for EUR/USD to trade above this level in the short-term.

EUR/USD Daily Price Chart (June 2020 – July 29, 2021)

Learn How to Use Sentiment in Your Trading Strategy}} Retail trader data show 54.34% of traders are net-long with the ratio of traders long to short at 1.19 to 1. The number of traders net-long is 4.55% lower than yesterday and 9.39% lower from last week, while the number of traders net-short is 2.54% higher than yesterday and 0.36% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests EUR/USD prices may continue to fall. Yet traders are less net-long than yesterday and compared with last week. Recent changes in sentiment warn that the current EUR/USD price trend may soon reverse higher despite the fact traders remain net-long.

What is your view on EUR/USD – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.