S&P 500, HANG SENG INDEX, ASX 200 OUTLOOK:

- Dow Jones, S&P 500 and Nasdaq 100 indexes closed +1.30%, 1.13% and +0.71% respectively

- Investors anticipate a strong Q2 earnings season, boosting sentiment. Treasuries fell

- China’s central bank unexpectedly cut the Reserve Requirement Ratio (RRR) for all banks

Earnings, RRR Cut, China GDP, US Core Inflation, Asia-Pacific Week-Ahead:

The S&P 500 index hit an all-time high on Friday as investors shrugged off concerns about the Delta variant and focused on the upcoming earnings season. The estimated earnings growth rate for the S&P 500 index in Q2 is expected to hit 64% YoY, marking the fastest expansion in more than a decade. Analysts have revised up their earnings forecasts from March to June as the economic recovery gathers pace. More blue chip companies have issued positive EPS guidance than those that issued negative outlook, according to data compiled by Factset.

Treasury yields rebounded sharply on Friday, with 10-year and 2 year rates rising 6.9bps and 2.2bps respectively to 1.363% and 0.215%. This reflects renewed reflation hopes and reduced demand for safety. The DXY US Dollar index pulled back for a second day from a 3-month high, reflecting eased concerns about the Fed tapering stimulus. A weakening US Dollar bolstered gold and crude oil prices, and may set a positive tone for Asia-Pacific equities at the open.

The People’s Bank of China (PBOC) unexpectedly cut the Reserve Requirement Ratio (RRR) for all banks by 50bps on Friday, releasing about 1 trillion Yuan of long-term liquidity into the economy. This aims to cushion “the impact of higher commodity prices on business production and operation” as indicated at the State of Council Meeting on Wednesday. The RRR cut surprised the market by both its magnitude and scope, underscoring slowing growth momentum in the world’s second-largest economy.

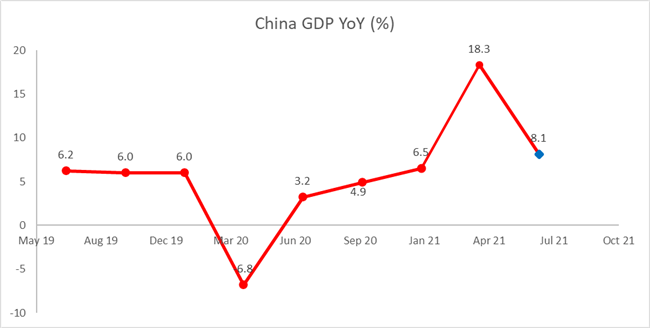

This put Thursday’s release of China 2Q GDP data under the spotlight. Output is expected to grow 8.1% YoY. A weaker-than-expected figure may reignite growth concerns and may weigh on equity market performance. The China Association of Automobile Manufacturers said that passenger car sales has likely fallen by 15% YoY in June, reflecting soft retail market sentiment.

China Q2 GDP Forecast (YoY)

Source: Bloomberg, DailyFX

APAC markets look set to kick off the week on the front foot after a broad-based rally on Wall Street. Futures were higher in Japan, Australia, Hong Kong, Taiwan, Singapore, Malaysia, India and Thailand. Those in mainland China and South Korea are trailing however.

Hong Kong’s Hang Seng Index (HSI) may rebound today after the PBoC eased monetary policy for the first time since April 2020. The technology sector had a “V-shaped” rebound on Friday as investors took the recent regulator crackdown as an opportunity to buy the dips. China’s release of Q2 GDP growth rate on Thursday may set the tone for trading. Near-term momentum remains tilted to the downside after HSI breached a key trendline support level.

For the week ahead, US core inflation and retail sales data dominate the economic docket alongside Chinese GDP. The RBNZ and BoJ interest rate decisions will also be closely eyed as well. Find out more from the DailyFX calendar.

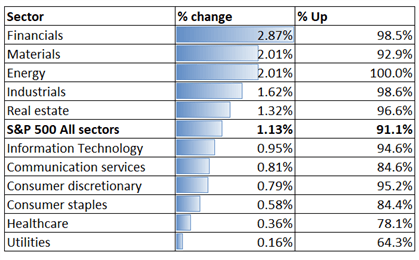

Looking back to Friday’s close, all 11 S&P 500 sectors ended higher, with 91.1% of the index’s constituents closing in the green. Financials (+2.87%), energy (+2.01%) and materials (+2.01%) were among the best performers.

S&P 500 Sector Performance 09-07-2021

Source: Bloomberg, DailyFX

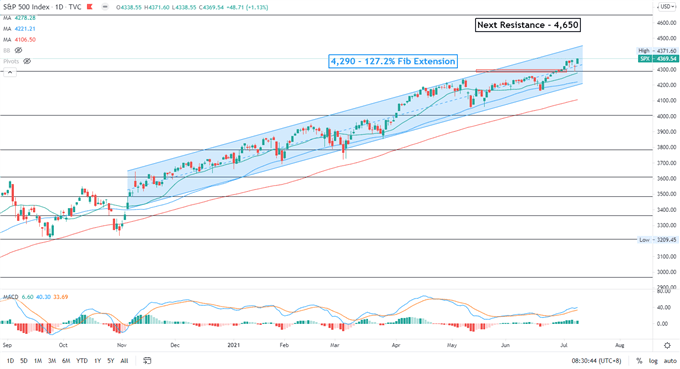

S&P 500 Index Technical Analysis

The S&P 500 index breached above a key resistance level at 4,290 and trended upward, carving a path for prices to attempt higher highs. The overall bullish trend remains intact as suggested by the “Ascending Channel”. The next resistance level can be found at 4,650 – the 161.8% Fibonacci extension. A pullback may lead to a test of the 20- and 50-day SMA lines for immediate supports.

S&P 500 Index – Daily Chart

Hang Seng Index Technical Analysis:

The Hang Seng Index breached below a supporting trendline and thus has opened the door for further losses. An immediate support level can be found at 27,150, breaking which may lead to a deeper pullback towards 26,200. The MACD indicator is trending lower below the neutral line, suggesting that bearish momentum may be dominating.

Hang Seng Index – Daily Chart

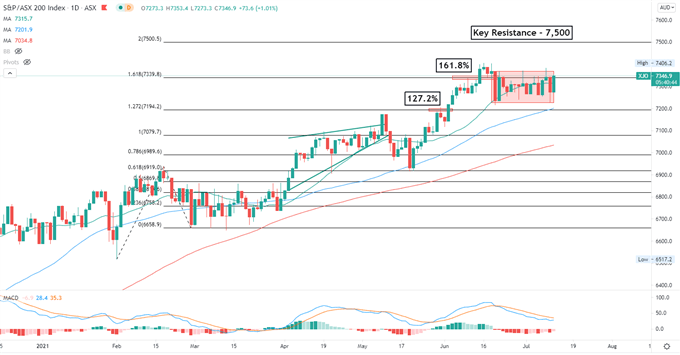

ASX 200 Index Technical Analysis:

The ASX 200 index is trading in a tight range between 7,230-7,370 waiting for fresh catalysts for a breakout. The overall trend remains bullish-biased, as suggested by the consecutive higher highs and higher lows formed in the past few months. A major resistance level can be found at around 7,500. The MACD indicator is trended lower, suggesting prices may continue to consolidate in the near term.

ASX 200 Index – Daily Chart

--- Written by Margaret Yang, Strategist for DailyFX.com

To contact Margaret, use the Comments section below or @margaretyjy on Twitter