British Pound (GBP) Price Outlook

GBP/USD is one of a number of crosses being driven lower by the strength of the US dollar ahead of the closely-watched US Jobs Report. Sterling, in itself, is marginally weaker over a number of crosses, but the recent sell-off in cable has been caused by the relentless grind higher by the greenback, which is touching a fresh 3-month high. Today’s NFP report will be parsed not just for the headline figure – 700k new jobs are expected to have been created – but also for average hourly earnings data. Last month’s jobs report showed wage pressured rising, and this situation is expected to remain the same, adding further credence to the view that the current above target levels of US inflation may prove to be stickier than first thought.

The latest batch of UK covid-19 data shows the number of new cases rising sharply, as the Delta variant runs amok. While new cases continue to soar, fatalities remain at a very low level, while hospital admissions are rising but to nowhere near levels seen in prior waves.

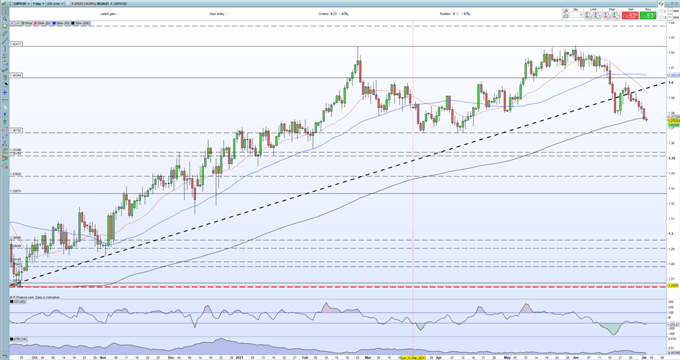

GBP/USD continues to eye the downside with 1.3670 now the next level of support. This level may prove difficult to break, having acted as strong support in late March and early April. The UK economy continues its strong rebound from post-pandemic lows, while inflation in the UK is already above target and likely to move higher in the short term. GBP/USD has enjoyed a strong rally over the last year, and as long as the series of higher highs and higher lows remains in place, this move higher is likely to re-start.

GBP/USD Daily Price Chart (April 2020 – July 2, 2021)

| Change in | Longs | Shorts | OI |

| Daily | 3% | -7% | -3% |

| Weekly | 4% | -10% | -5% |

Retail trader data show 66.30% of traders are net-long with the ratio of traders long to short at 1.97 to 1. The number of traders net-long is 4.85% higher than yesterday and 32.81% higher from last week, while the number of traders net-short is 1.41% higher than yesterday and 22.70% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests GBP/USD prices may continue to fall.Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger GBP/USD-bearish contrarian trading bias.

Traders of all levels and abilities will find something to help them make more informed decisions in the new and improved DailyFX Trading Education Centre

What is your view on Sterling– bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.