Bitcoin (BTC/USD) Talking Points:

- Bitcoin breached the key psychological level of $30,000 for the first time since January

- The Jan 22 swing low of $28,800 came in to help cauterize support

- Major cryptocurrencies currently remain at the mercy of risk aversion

Bitcoin (BTC/USD) prices have returned to February 2021 lows as China continues to clamp down on the cryptocurrency space. After falling below the key psychological level of $30,000, Bitcoin (BTC/USD) bulls have managed to regain control over price action whilst honoring support and resistance structure, with today’s low printing right around the Jan 22 swing low of $28,800.

The analysis contained in article relies on price action and technical analysis. To learn more check out our DailyFX Education section.

Bitcoin (BTC/USD) Technical Analysis

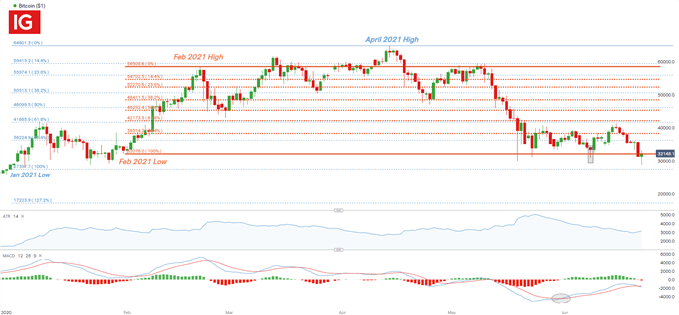

After reaching its peak on 14 April 2021, an influx of bears, driven by both regulatory and environmental concerns, helped to push the major cryptocurrency back to the psychological level of $30,000. A similarly contentious test showed in mid-May, but buyers were able to jump in and re-take control above the 30k marker ($30,066, to be exact). This morning saw no such fortune for bulls, as Bitcoin temporarily breached the 30k level and fell all the way down towards that prior swing low of $28,800 before starting to recover.

Bitcoin (BTC/USD) Daily Chart

Chart prepared by Tammy Da Costa, IG

Since the announcement of Bitcoin as a form of payment for Tesla vehicles in February 2021, the institutional adoption of major cryptocurrency supported the strong rally which saw prices rising above $65k. However, after the Bitcoin reversal by Tesla/Musk (due to the high energy consumption of Bitcoin mining), a massive re-pricing has been underway and BTC/USD has retreated back to early 2021 levels.

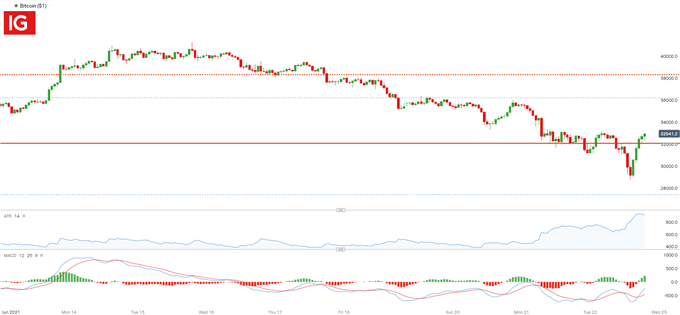

Bitcoin Hourly Chart

Chart prepared by Tammy Da Costa, IG

Meanwhile, from a short-term perspective, the downward pressure on price action was confirmed with a rise in the ATR, the technical indicator often used as confirmation of a sharp move. With a MACD crossover occurring below the zero line, the probability of a move higher cannot be ruled out.

With that being said, current support remains at a big area on the long-term Bitcoin chart, hovering around that 30k level that’s held multiple inflections over the past five months. On a shorter-term basis, there’s Fibonacci support around $32,076 (February low) with the next level of support residing at the psychological level of $30,000.

Meanwhile, current resistance holds at the 88.6% retracement of the Jan 22 – April 14 major move, coming in at at $32,194, after which another Fibonacci retracement rests at $34,415. The next big level beyond that is the $35,000 psychological level.

--- Written by Tammy Da Costa, Market Writer for DailyFX.com

Contact and follow Tammy on Twitter: @Tams707