GOLD PRICE OUTLOOK:

- Gold prices extended higher during APAC trading hours as yields and the US Dollar fell

- Demand for safety remains elevated as traders are jittery about the unwinding of the “reflation trade”

- Gold prices are challenging the 100-Day SMA line. Breaking it may hint at further upside potential

Gold prices rallied to an eight-week high as viral resurgence in some parts of the world dampened the growth outlook, boosting the demand for safety. While stocks have rebounded overnight, the market remains jittery about the unwinding of “reflation trades”. This encouraged investors to reassess recovery prospects and reshuffle their portfolios towards a more balanced setting.

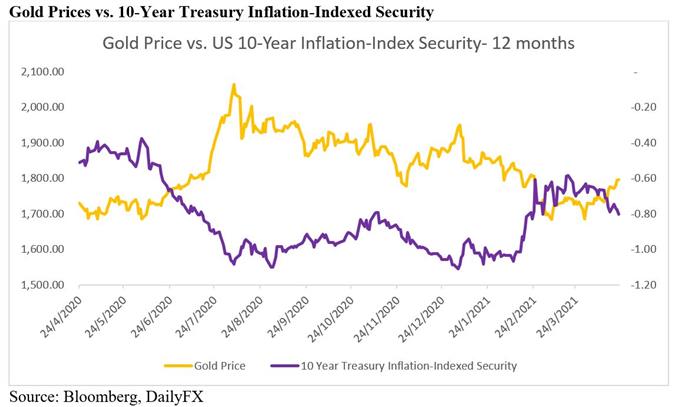

Haven-linked Treasuries were bid during early in the APAC trading session, sending the 10-year rate to a six-week low of 1.538%. The real yield, as represented by the 10-year inflation-indexed security, also declined by 2 bps to -0.80%. Falling real yields boosted the appeal of precious metals as the opportunity cost of holding them decreased.

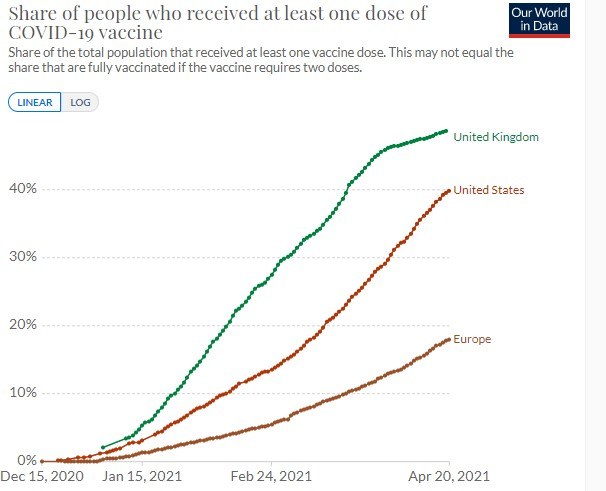

Traders will also keep an eye on the upcoming ECB interest rate decision for clues about the central bank’s monetary policy guidance. The ECB is widely expected to keep its policy unchanged and maintain an accommodative stance amid a third viral wave in the region. A relatively slower pace of vaccination compared to the UK and US suggests that the Eurozone is likely to suffer greater economic hardship in the months to come. Against this backdrop, the chance for the ECB to stay dovish is higher.

The risk is when the central bank decides to pull back the Pandemic Emergency Purchase Programme (PEPP) after front-loading payments in March. ECB President Christine Lagarde will hold a press conference after the meeting, and her speech will be closely scrutinized by currency and gold traders.

Share of People Who Received at Least One Dose of Covid-19 Vaccine – US, UK and EU

Source: Our World in Data

Technically, gold has likely formed a “Double Bottom” chart pattern after hitting US$ 1,677 twice. The “Double Bottom” pattern usually appears at the end of a downtrend and may be viewed as a strong bullish signal. Prices breached above an immediate resistance level at US$ 1,785 - the 38.2% Fibonacci retracement- and thus opened the door for further upside potential.

The next resistance level can be found at the 100-day SMA line (1,794). A daily close above this level would likely intensify near-term buying pressure and expose the next resistance level of US$ 1,818 – the 50% Fibonacci retracement. A swing lower however, may bring the immediate support level of US$ 1,785 (previous resistance) into focus.

Gold Price – Daily Chart

| Change in | Longs | Shorts | OI |

| Daily | 1% | -3% | -1% |

| Weekly | 2% | -8% | -2% |

--- Written by Margaret Yang, Strategist for DailyFX.com

To contact Margaret, use the Comments section below or @margaretyjy on Twitter