Key Talking Points:

- The Pound faces short-term risks which are putting pressure on an overly optimistic start of the year

- EUR/GBP buyers consolidate further upside momentum

With supply issues causing the UK vaccination campaign to fall off track some of the Pound’s appeal has worn off. But the loss of its vaccine-related advantage is not the only cause for concern for the British currency as it faces other headwinds in the short term.

There is also a rise in tensions in Northern Ireland as unionists gather violently to show their opposition to the treatment of Northern Ireland in the post-Brexit trade deal. Whilst not necessarily a direct link to the currency, in conjunction with the looming Scottish election in May we are likely seeing some investors get jitterish about the current political climate in the UK, adding fuel to the current unwind in speculative positions after so much positive sentiment was priced into the Pound at the beginning of the year.

The good news is that these issues are temporary in nature and are likely to be resolved within the next month, at which point GBP buyers are likely to be in a better position to come into the market.

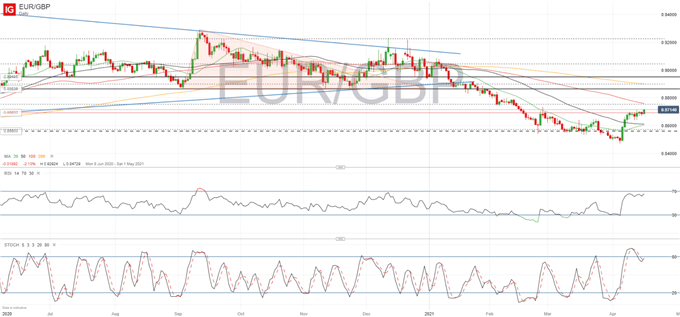

One of the pairs worth focusing on is EUR/GBP which has staged a remarkable reversal in the last few weeks after trading in one direction for the most part of 2021. The EU’s resolution to their own vaccine issues is likely a big factor in this change of trend, which allowed EUR buyers to correct highly oversold conditions in EUR/GBP.

Remarkably, the pair is still pushing higher after clearing a key resistance along the way (0.8693). Looking at the daily chart, the fact that buyers have remained in control after a period of sideways consolidation has only reinforced the bullish momentum in the short term. The next objective is likely to be at 0.8756, where a key Fibonacci level and the 100-day SMA are in confluence, although buyers could take the pair as high as 0.8863 in the next few weeks if upside pressure persists.

To the downside, 0.8600 is likely to be the key support area as the round level coincides with the current 20 and 100-day SMAs. If this upside reversal in EUR/GBP turns out just to be a temporary correction in the longer-term descending trend then expect to see the pair attempting to break below 0.8470 in the medium term.

EUR/GBP Daily chart

Retail trader data shows 47.66% of traders are net-long with the ratio of traders short to long at 1.10 to 1. The number of traders net-long is 2.99% lower than yesterday and 12.18% lower from last week, while the number of traders net-short is 6.54% higher than yesterday and 14.23% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests EUR/GBP prices may continue to rise.

Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EUR/GBP-bullish contrarian trading bias.

Learn more about the stock market basics here or download our free trading guides.

--- Written by Daniela Sabin Hathorn, Market Analyst

Follow Daniela on Twitter @HathornSabin