Key Talking Points:

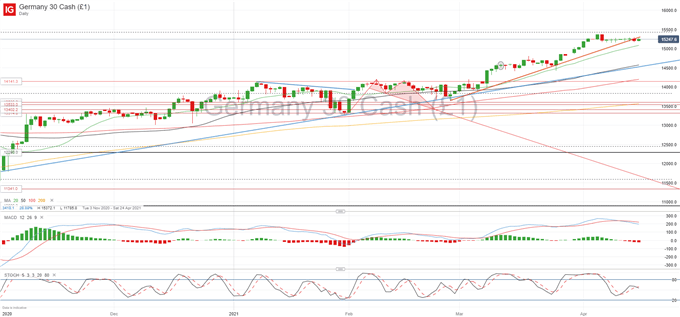

- DAX 30 sticks to tight range, risks falling below 15,000

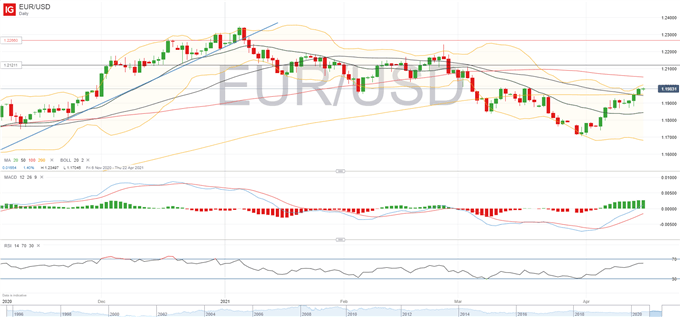

- EUR/USD targets 1.20 as positive sentiment flows into the common currency amid Dollar weakness

The DAX 30 had a shaky finish to yesterday’s session as the listing of Coinbase on the Nasdaq saw some robust selling pressure as trading got underway. Equities have been on a strong uptrend since the beginning of March when economic data was showing strong improvements and bond yields were calming down after a wild ride in January and February.

The current backdrop is still supportive of the stock market as the massive amounts of stimulus poured into the economy is aiding economic recovery, but Central Banks are still cautioning about a few tough months ahead as the vaccine has its full effect on containing the spread of Covid-19. In Europe, the epidemiological situation has worsened once again, with many countries having to reimpose tough restrictions to try and curb the spread of the virus. The imminent threat of mobility restrictions over the summer period is a tough reality for countries that are highly dependent on the tourism sector, making those in the south the most affected.

DAX 30 Levels

The German index is keeping to its tight range as sellers and buyers fight to take control. The recent pattern of indecision, which includes several doji candlesticks, could be forecasting a near-term downturn, especially as they have emerged close to a new all-time high. Current price has also slipped below the ascending trendline which is signaling further weakness, at the same time that the stochastic oscillator is nearing the neutral mark of 50 and the MACD is pressing into negative territory. Look out for a break below 15,140 as a sign that sellers are gearing up to bring the index below 15,000, a psychological area of support that is likely to stop selling pressure, even if only momentarily.

DAX 30 Daily chart

| Change in | Longs | Shorts | OI |

| Daily | -9% | 7% | 2% |

| Weekly | -27% | 9% | -5% |

EUR/USD Levels

In the FX space,the common currency has been in an upbeat mood over the last week, mostly due to strong economic data and the progress made in Europe’s vaccination program after a few bumps along the way. EUR/USD continues its strong uptrend on the back of persistent weakness in the US Dollar. As investors are shying away from the bond market and the fact that the US economic recovery rhetoric has been plaid down slightly is attracting fresh inflows into the euro. The common currency had also had a lot of negative sentiment priced in so this is also likely to be an unwinding of those short trades.

The pair’s gradual approach to the psychological 1.20 mark is setting up a good technical picture to attempt a break higher. Momentum indicators are strongly positioned to the upside, although traders may be cautious of a bearish DMA cross as the 50-day DMA has fallen below the 200-day DMA for the first time since January 14th. I wouldn’t be surprised if EUR/USD is rejected just before 1.20 as it has happened twice before in the last month, but I think the pair is in a healthier position to break higher this time around, so I would set my next target at 1.2046. As always, keeping an eye on key support levels if sentiment turns bearish, with immediate focus on the 50 and 200-day SMA confluence at 1.1946.

EUR/USD Daily Chart

Learn more about the stock market basics here or download our free trading guides.

--- Written by Daniela Sabin Hathorn, Market Analyst

Follow Daniela on Twitter @HathornSabin

.jpg)