EURO STOXX 50 TALKING POINTS

- Euro Stoxx 50 declined by 0.34%, settling just below a post-pandemic high of 3,986

- Investors shift focus to rising coronavirus cases, Fed minutes, and Eurozone economic data

- Vaccination continues to be key for Europe, as countries relapse on lockdowns and restrictions

European equity benchmarks closed mostly in the red on Wednesday as investors shifted focus to Eurozone economic data and the rise in coronavirus cases. Europe has notably struggled with vaccinating its populous, as distribution bottlenecks and discontent over additional lockdowns take centerstage.

The European Union lags counterparties such as the United States, the United Kingdom, and Israel when it comes to vaccinating the greater public. Brussels’ inability to negotiate with suppliers and distribute vaccines to member states has caused unrest in recent weeks, as the angst amongst the general population grows with each passing day.

Europe has had a well-documented tussle with AstraZeneca over their COVID vaccine, as reports surfaced of the company’s doses potentially leading to fatal blood clots. Suppliers have slashed delivery forecasts to Europe, as American restrictions pressure supply chains.

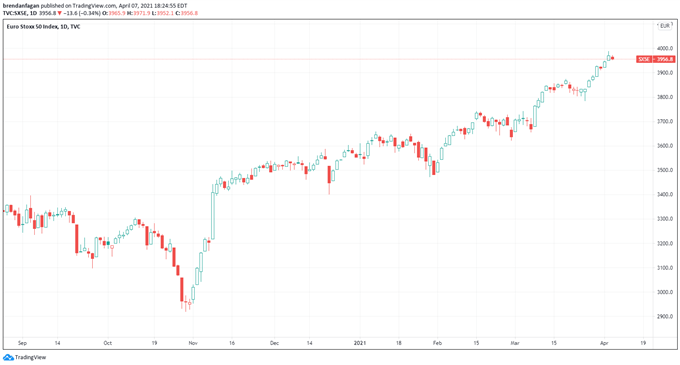

Euro Stoxx 50 Daily Chart

Chart created with TradingView

Under the Defense Production Act, US-based producers of COVID vaccines have been forced to meet the needs of the domestic population before any thought can be given to international constituents. Europe has enacted similar restrictions, limiting exports of vaccines to countries with higher rates of vaccination, most notably the United Kingdom.

While the public continues to grow anxious regarding vaccines, European equity benchmarks broadly continue to point higher. It appears that investors view issues related to lockdowns and vaccine distribution as temporary. Should vaccinations pick up significantly, a stronger than expected recovery potentially remains on the cards for Europe and its various equity markets.

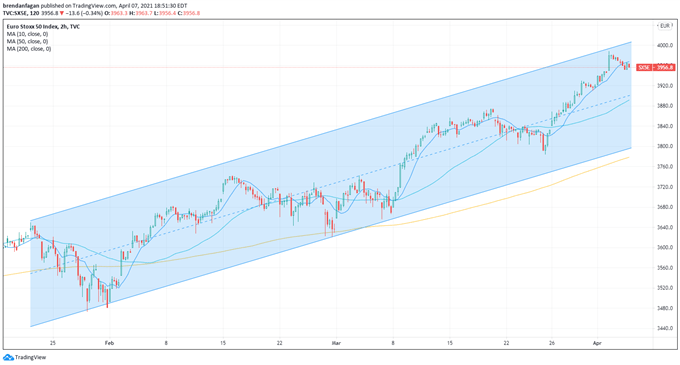

Euro Stoxx 50 2-Hour Chart

Chart created with TradingView

While a cloud of uncertainty continues to loom over the EU, the Stoxx 50 Index has remained in an upward channel for the last two months. Despite the Stoxx 50 pulling back from the upper bound of this two month channel over the last week, the index’s recent trend remains intact. Vaccine related green shoots may propel the Index back toward the upper bound and potentially beyond, following the S&P 500 beyond 4,000.

However, with many questions still surrounding vaccine distribution and rising cases, Europe still has much to fear. Any setbacks in terms of the continental reopening could see the index tag its 50-period SMA around 3,890, or potentially its 200-period SMA at 3,780. Much of the direction in the near term hinges solely on whether Brussels can get its act together and distribute the various vaccines to its 27 member-states, who continue to wait patiently. However, that patience may be starting to run thin.

--- Written by Brendan Fagan, Intern for DailyFX

To contact Brendan, use the comments section below or @BrendanFaganFX on Twitter