Swiss Franc Outlook: USD/CHF May Rise in Q2 Amid Favorable Yield Differentials

The US Dollar received a bid in the first quarter of 2021, but its trading has been uneven. Some of its best performance, within the G10 currency space, has been against the Swiss Franc. A fairly swift vaccination rollout and President Joe Biden’s US$1.9 trillion package have boosted economic growth expectations in the world’s largest economy.

That has in turn pushed up inflation bets and longer-term Treasury yields. Traders are slowly bringing forward prospects of the Federal Reserve unwinding some of the extraordinary easing measures undertaken amid last year’s coronavirus outbreak. Meanwhile, government bond yields have been on the rise in Switzerland as well, but the entire yield curve remains below zero.

The Swiss National Bank (SNB) has struggled to bolster inflation for years, having some of the lowest benchmark lending rates amongst major central banks. Vice President Fritz Zurbruegg hinted at keeping rates deeply negative while continuing currency intervention efforts for the time being. The latter is in part due to Switzerland’s export-oriented economy.

Last year, the SNB had to aggressively ramp up total sight deposits, a proxy of foreign exchange reserves, to prevent the anti-risk CHF from appreciating too rapidly as stocks tanked. The central bank has welcomed recent depreciation in its currency. In fact, the Franc struggled to capitalize against the US Dollar despite wobbly global stock markets in the first quarter.

The Franc’s struggle is likely due to rising bond yields in the United States relative to Switzerland, and may continue throughout the second quarter as the White House sets course to deliver infrastructure spending after Covid relief. As such, the US Dollar may resume its appreciation against the Swiss Franc. But, where might USD/CHF go if the path of least resistance is higher?

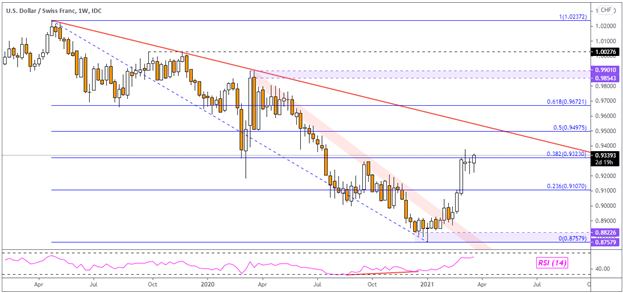

Looking at a weekly chart, the pair took out falling resistance from last year. That has placed the focus on a descending trendline from April 2019. The technical milestone could end up being a major zone of resistance that if taken out, may imply a broader resumption of January’s reversal. Otherwise, there may be room for a near-term pullback to key Fibonacci retracement levels highlighted below.

USD/CHF Weekly Chart

Chart prepared by Daniel Dubrovsky, created with TradingView