British Pound (GBP) Price Outlook – GBP/USD and EUR/GBP Chart and Analysis

- Vaccination program continues at speed.

- UK GDP data the only economic release of note.

The UK vaccination program continues to forge ahead with more than 30 million people having had a first dose of covid-19 vaccine, while in excess of 3.5 million people have had two doses. The UK government says that the program is still on target despite the recent supply problems and the ongoing vaccination nationalism spat with the European Union. In further good news, the Moderna vaccine is due to be rolled out in the UK in mid-April. The UK government has already ordered 17 million doses of the vaccine which has a 94% efficacy.

The UK has also started its unlock down program Monday, with two households or groups of up to six people now allowed to meet in outdoor areas. According to the BBC, the government will also roll-out a new slogan today – Hands, Face, Space and Fresh Air – to stress the importance of meeting outdoors.

There is little in this bank holiday shortened week in the way of UK data apart from the final UK Q4 GDP release on Wednesday at 09:30 GMT. Recent market upgrades suggest that UK growth has not been hit as badly as originally feared and this week’s figures may provide another positive boost for Sterling.

For all market moving data and events, see the DailyFX Calendar

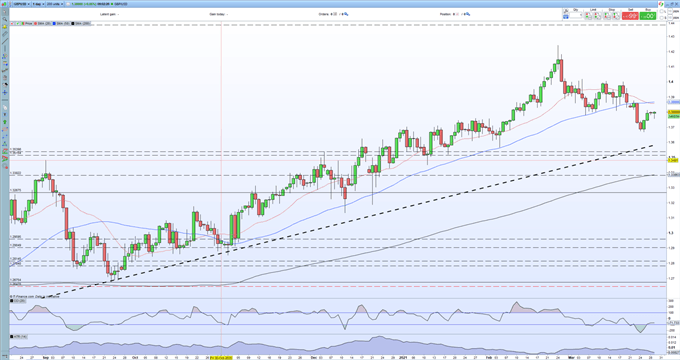

GBP/USD is now inching back above 1.3800 and is looking to probe higher after last Tuesday’s sharp sell-off. The 50-day simple moving average (blue line) had been supporting the pair over the last few months but last week’s break and open below sent the pair tumbling. Initial resistance for cable will now come from the 20- and 50-day smas at 1.3856 and 1.3866 respectively before a gap appears to the old resistance zone of 1.4000-1.4020.

Popular Moving Averages and How to Use Them

GBP/USD Daily Price Chart (August 2020 – March 29, 2021)

| Change in | Longs | Shorts | OI |

| Daily | 3% | -7% | -3% |

| Weekly | 4% | -10% | -5% |

Retail trader data show 53.96% of traders are net-long with the ratio of traders long to short at 1.17 to 1.We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests GBP/USD prices may continue to fall.Yet traders are less net-long than yesterday and compared with last week. Recent changes in sentiment warn that the current GBP/USD price trend may soon reverse higher despite the fact traders remain net-long.

Traders of all levels and abilities will find something to help them make more informed decisions in the new and improved DailyFX Trading Education Centre

What is your view on GBP/USD – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.