British Pound (GBP) Price Outlook – GBP/USD Chart and Analysis

- BoE and the Fed on tap.

- GBP/USD remains supported.

While both the Federal Reserve and the Bank of England will likely leave all policy settings untouched over the next day, both central banks have the power to move their respective currencies with their post-decision commentary. Both central banks will give their latest views on growth and inflation as always but these meetings will also see both the Fed and the BoE discuss the recent surge in government yields. While yields are pushing higher on improving economic sentiment and higher inflation expectations, the increase in borrowing costs for both countries comes at an unwelcome time after both have underwritten their economies with extraordinary amounts of monetary stimulus. For the FOMC and BoE release times, see the DailyFX Calendar

US Dollar Forecast: FOMC Summary of Economic Projections to Dictate USD

Sterling continues to benefit from the speed and size of the UK vaccination program. As of Tuesday, nearly 25 million people have received their first vaccination dose, while 1.66 million have had a second dose. It is expected that all over 50s – the nine priority groups - will have been given at least one dose by the end of March, ahead of the UK government’s schedule.

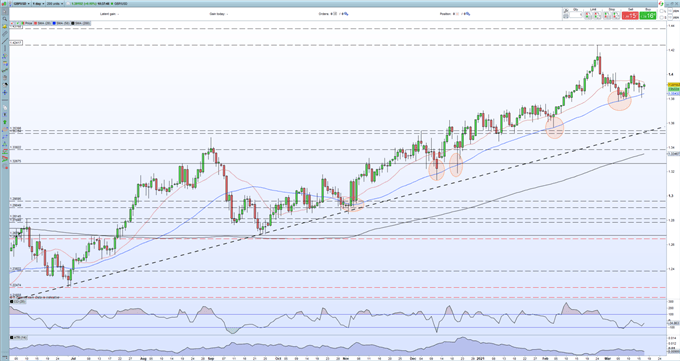

GBP/USD trades just above 1.3900 and the daily chart shows how the 50-day simple moving average (blue line) remains a supportive indicator. The 50-day sma has provided support from early November and continues to hold when tested. The 20-day sma is also in play now and acting as short-term resistance for the pair. A close and open above here – currently 1.3938 – is needed before GBP/USD can test 1.4022, the February 22 high. After here the recent multi-year high at 1.4242 comes back into play. Volatility remains slightly below recent multi-week highs but may move higher in response to commentary from either central bank meeting.

Popular Moving Averages and How to Use Them

GBP/USD Daily Price Chart (June 2020 – March 17, 2021)

| Change in | Longs | Shorts | OI |

| Daily | 3% | -7% | -3% |

| Weekly | 4% | -10% | -5% |

Retail trader data show 51.12% of traders are net-long with the ratio of traders long to short at 1.05 to 1. We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests GBP/USD prices may continue to fall.

Yet traders are less net-long than yesterday and compared with last week. Recent changes in sentiment warn that the current GBP/USD price trend may soon reverse higher despite the fact traders remain net-long.

Traders of all levels and abilities will find something to help them make more informed decisions in the new and improved DailyFX Trading Education Centre

What is your view on GBP/USD – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.