Key Talking Points:

- Equities continue to rise as economic expectations improve

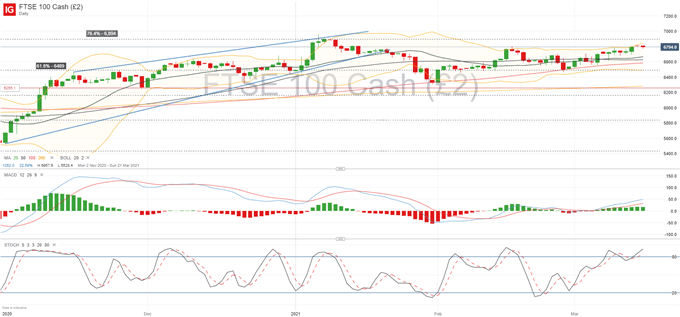

- FTSE 100 struggling to break above 6,810

Equities are soaking up as much bullish sentiment as possible as $1,400 stimulus checks hit the bank accounts of many US citizens and President Biden asserts that normalcy will return to the country by July 4th, at which point all adults are expected to have received the second dose of the Covid-19 vaccine.

This has led to the expectation that the US economy will rebound sharply in the second half of the year, which in turn will see a sharp rise in prices and inflation, which has led to the volatility we’ve seen in the bond market in the last few weeks. This has spilled over to Europe and Asia with the DAX pushing above all-time highs and many indices seeing their highest levels since before the pandemic started back in March 2020.

European bond yields are also picking up pace but many Central Banks are conveying the same message as the Fed, as they expect inflation to push above the upper bound of their comfort range as the economy recovers in the latter part of 2021. But investors are still concerned that unsupervised rising bind yields pose a significant threat to borrowing costs, dampening the prospects of further economic recovery, and leaving stocks in a position where they will become overly expensive.

BOE BAILEY IS MORE POSITIVE ABOUT THE ECONOMY

Bank of England Governor Andrew Bailey has been the latest to show his improved expectations about the future of the economy as he talked to BBC radio this morning. He sees a build-up in savings as a positive risk and expects inflation to near the 2% target in the next few months, all whilst he expects the May forecast to show a decrease in the unemployment rate. On the topic of rising yields, he says the bank will keep a close eye on the bond market as he believes the rise in rates signals the change in economic outlook.

FTSE 100 Levels

The FTSE 100 is once again positioned just below the upper bound of its Bollinger range which is located around the 6,800 area. Momentum indicators show overbought conditions on the Stochastic oscillators and the MACD is starting to undo its bullish cross, which could lead to another pullback towards its center level. As mentioned above, the perception that stocks are under pressure if bond yields continue to rise is still prominent, so I expect European equities to struggle to find much further upside if current conditions remain.

That said, if US equities are able to capitalize further on current bullish support then we could see European indices follow suit for a little longer. For the FTSE 100, the 76.4% Fibonacci (6,894) is likely to be a strict short-term top if further upside is attained, although I expect the Bollinger range to continue to apply throughout the next few days, so today’s high at 6,810 could be the current short-term top. To the downside 6,600 remains as an important area of support, but increased bearish pressure could see the index retrace to the 61.8% Fibonacci at 6,489.

FTSE 100 Daily chart

| Change in | Longs | Shorts | OI |

| Daily | -30% | 25% | 2% |

| Weekly | -44% | 44% | 0% |

Learn more about the stock market basics here or download our free trading guides.

--- Written by Daniela Sabin Hathorn, Market Analyst

Follow Daniela on Twitter @HathornSabin