Euro Price, News and Analysis:

- German retail sales slump on covid-19 lockdown.

- Euro Area inflation in line with market expectations.

- EUR/USD struggling to hold 1.2000.

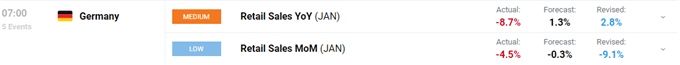

The latest release of German retail sales data missed market expectations by some margin, with all the main numbers in negative territory. According to the German statistics office, Destatis, the slump in retail trade was caused by the second covid-19 lockdown, ‘which led to a partial retail closure starting on 16 December 2020’.

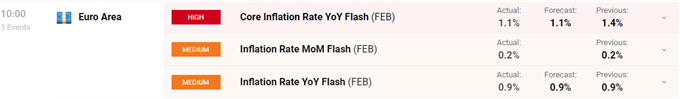

The first look at Euro Area inflation data came in line with market expectations, with a core year/year reading of 1.1%, from a prior 1.4%, in February, while headline inflation was recorded at 0.9%. The January inflation data showed inflation rising at the fastest rate in nearly a decade, fueled by one-off price increases and a change in the weighting of certain products.

For all market-moving economic data and events, see the DailyFX Calendar.

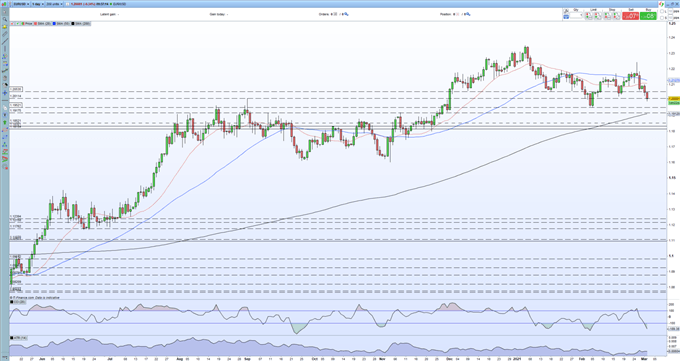

EUR/USD is slipping back towards levels last seen nearly one-month ago and is eyeing the February 5 multi-week low print at 1.1952. The pair trade below both the 20- and 50-day simple moving averages and are less than one point away from the 200-day sma at 1.1912. The CCI reading indicates the pair is oversold and this may temper the speed of any further sell-off.

EUR/USD Daily Price Chart (May 2020 – March 2, 2021)

| Change in | Longs | Shorts | OI |

| Daily | -1% | -4% | -3% |

| Weekly | 4% | -10% | -5% |

IG Retail trader data show 50.52% of traders are net-long with the ratio of traders long to short at 1.02 to 1. We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests EUR/USD prices may continue to fall. Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EUR/USD-bearish contrarian trading bias.

What is your view on EUR/USD – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.