USD/ZAR Price Analysis:

- South African Budget Speech Boosts Sentiment

- USD/ZAR Poised by Psychological Support

- US Dollar Weakness Prevails ahead of Stimulus Vote

The South African Rand continued to strengthen against the greenback after South African Finance Minister Tito Mboweni presented the annual budget speech earlier today, highlighting the Fiscal Framework for the next financial year. Although the Emerging Market (EM) is expected to rebound by approximately 3.3% , high levels of government debt, mismanagement of funds by State Owned Enterprises (SOE’s) and rising unemployment were exasperated by the Coronavirus pandemic, resulting in stringent lockdown measures, further hindering business activity and economic growth.

Visit the DailyFX Educational Center to discover why news events are Key to Forex Fundamental Analysis

As the National Treasury presented its plan to stabilize government debt, with the current budget deficit sitting at a staggering 14% of GDP, the dovish rhetoric of Federal Reserve Chair Jerome Powell continued to weigh on the Dollar, bolstering the demand for Emerging Market (EM) currencies, allowing the downward trajectory pertaining to USD/ZAR to persist, pushing prices to a 13 month low.

USD/ZAR Technical Analysis

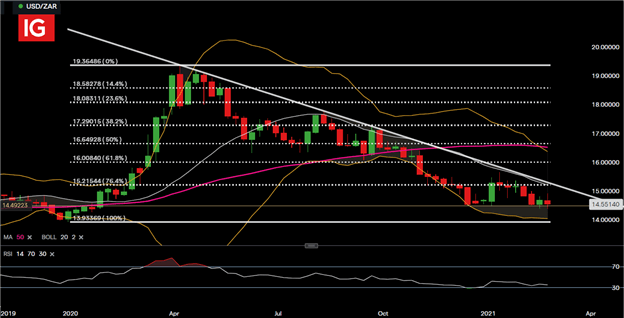

USD/ZAR price action currently remains within a zone of confluency, between two key psychological levels, that have continued to provide support and resistance for the pair. Meanwhile, the Relative Strength Index (RSI) on the weekly time-frame continues to test the lower bound of the range, threatening to break below 30. If the RSI crosses below 30 and bears are able to break below current support of 14.50, then the downward momentum may drive price action to the 100% Fibonacci retracement level of the 2020 move, at 13.93.

USD/ZAR Weekly Chart

Chart prepared by Tammy Da Costa, IG

In the short-term, price action currently remains within the limits of the Bollinger Band with the RSI residing within normal range. The lower bound of the Bollinger band has formed an additional layer of support at a level of 14.38 while the 50-Day Moving Average provides additional resistance just short of the 15.00 key psychological level.

USD/ZAR Daily Chart

Chart prepared by Tammy Da Costa, IG

--- Written by Tammy Da Costa, Market Writer for DailyFX.com

Contact and follow Tammy on Twitter: @Tams707