EUR/USD Price, News and Analysis:

The yield on the 10-year US Treasury hit its highest level (1.196%) in a year earlier in the European session, pushing the US dollar basket higher. US Treasury yields have been on the rise for the last few weeks as the US economy continues to pick-up from its pandemic-induced low. As inflation expectations start to grow further down the line, longer-dated US Treasuries reflect this by moving higher. One closely followed indicator – the 2/10-year UST spread - is at its widest level in over three years, due in part to rising inflation expectations and the Fed’s ongoing willingness to anchor short-term interest rates. In addition, the 10-year US Treasury offers over 160 basis points more yield than the German 10-year Bund, with this additional ‘carry’ helping to boost the US dollar against the Euro.

For all market-moving economic data and events, see the DailyFX Calendar.

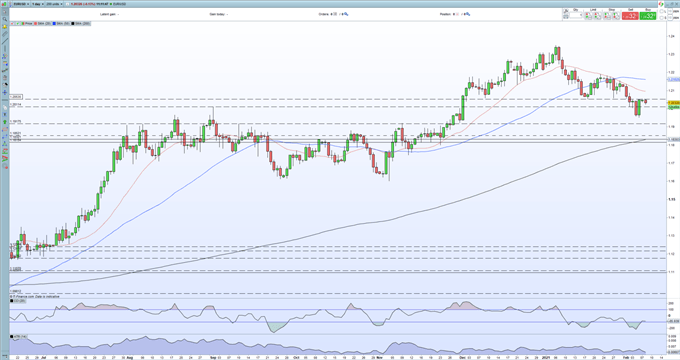

Horizontal resistance around 1.2053 to 1.2058 is currently capping the pair’s upside, while the recent move below the 20-day simple moving average brings another level of resistance just under 1.2100. The first level of EUR/USD support kicks-in around 1.1920 which will take us back to levels last seen at the end of November. The pair have nearly finished making a rough head and shoulders pattern, and lower prices look more likely if this bearish pattern plays out.

EUR/USD Daily Price Chart (June 2020 – February 8, 2021)

| Change in | Longs | Shorts | OI |

| Daily | -1% | -4% | -3% |

| Weekly | 4% | -10% | -5% |

IG Retail trader datashow 41.05% of traders are net-long with the ratio of traders short to long at 1.44 to 1.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests EUR/USD prices may continue to rise.Positioning is more net-short than yesterday but less net-short from last week. The combination of current sentiment and recent changes gives us a further mixed EUR/USD trading bias.

What is your view on EUR/USD – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.