EUR/USD, EUR/JPY Price Analysis & News

Eurozone GDP Recap

EU GDP Q4 Y/Y: -5.1% vs Exp. -5.4% (Prior -4.3%) - Q/Q: -0.7% vs Exp. -1% (Prior 12.5%)

Eurozone GDP printed slightly better than expectations, which is of little surprise given the slightly better than expected readings for both France and Germany. In turn, the reaction in the Euro had been muted. Keep in mind as well that this data is somewhat outdated, particularly with the majority of the Eurozone under lockdown measures at present and thus downside risks are likely to persist throughout Q1. However, the GDP data does highlight the diminishing impact of restrictive measures on economic activity.

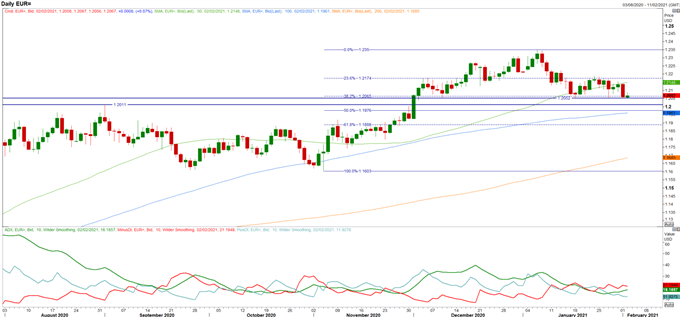

EUR/USD at Risk of a Further Deterioration

EUR/USD:The Euro got off to a sluggish start to the week with the currency making a firm break below its 50DMA, which in turn is likely to reinforce the short-term bearish outlook. Alongside this, the Euro has largely felt the brunt of a USD that is in recovery mode, which yesterday broke above its downtrend and thus the 91.00 level is in focus for the greenback. Should the USD print a close above the 91.00, there may be more room for further upside in the dollar, particular with other pair posting key breaks, such as USD/JPY. That said, the chaotic rollout of the vaccine program has not helped matters for the Euro, which has seen the currency underperform, particularly against those currencies that have been underpinned by a successful vaccine rollout (namely GBP). As such, EUR/USD is testing support at 1.2065 (38.2% retracement of Nov-Jan rise), which had held firm throughout January. That said, a close below opens the door to 1.2000-11 where Euro longs are likely to liquidate below this area.

EUR/USD Chart: Daily Time Frame

Source: Refinitiv

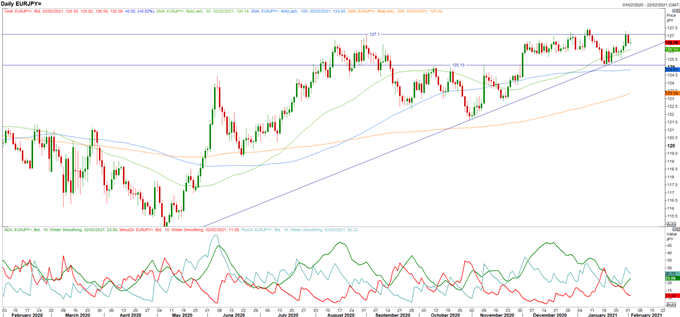

EUR/JPY Struggling at Topside Resistance

EUR/JPY: Trend signals are beginning to ease as EUR/JPY stumbles at 127.00 yet again. For now, the uptrend remains intact, however, that view will be challenged on a break below 126.14, which raises the risk of a test of trendline support. That said, I will be placing a close eye on Italian politics for the near-term EUR/JPY outlook. Overnight, talks had been reportedly blocked over policy issues, while certain parties have called for a major cabinet shake-up. However, while the worst-case scenario of snap-elections is a very low probability, heightened political risk premium is likely to keep EUR/JPY upside capped.

EUR/JPY Chart: Daily Time Frame

Source: Refinitiv

| Change in | Longs | Shorts | OI |

| Daily | -9% | 0% | -3% |

| Weekly | 17% | -22% | -11% |