USD/ZAR ANALYSIS

- Lekgotla positive but not comprehensive

- Biden imposes travel ban on South Africa

RAND FUNDAMENTAL BACKDROP

This weekend involved several potential ZAR stimuli with focus on the ANC NEC lekgotla (government strategy meeting). Last night President Cyril Ramaphosa addressed the nation with regard to their discussion points as follows:

- Issues of inequality between men and woman in South Africa

- COVID-19 vaccine focus

- How COVID-19 accentuated several longstanding issues within the country

- South Africa’s role in contributing to global climate change

The main focus for markets and the local public alike was the COVID-19 vaccine rollout. Unfortunately, the President did not provide any detailed information on the subject. Until such time as there is more clarity on the inoculation program, South Africans will remain cautious about the vaccine.

In addition to local news, President Joe Biden announced that a travel ban will be executed on South Africa as a solution to the new COVID-19 variant strain. With travel and tourism already at record lows in South Africa, this should not impact the Rand significantly which is apparent today.

TECHNICAL ANALYSIS

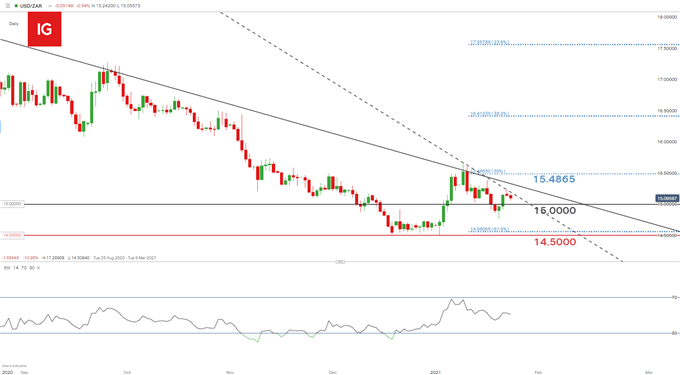

USD/ZAR DAILY CHART

Chart prepared by Warren Venketas, IG

After Friday’s global hesitation on U.S. stimulus due to added COVID-19 restrictions, the Rand has recovered today after a weekend of several detrimental announcements. The medium-term downtrend (black line) may be surpassed by a stronger downward trend (dashed black line) which could suggest diminishing bullish momentum.

The Relative Strength Index (RSI) remains around the midpoint 50 level which indicates uncertainty in terms of directional momentum however the overall trend remains firmly bearish. This fluctuation between short-term bullish and bearishness will likely continue going forward but it is improbable that the medium-term downtrend will be altered unless the global economic environment takes a drastic turn.

USD/ZAR bulls may look at the short-term resistance trendline (dashed black line) as an initial target, while the medium-term resistance trendline will serve as secondary resistance. The long serving 15.0000 level of confluence will remain as initial support for bears while the medium-term outlook around the 14.5000 support zone will stay in place going forward. Price action is expected to wade through the 15.4865 and 14.5000 region for 2021 with price favorability heavily dependent on the U.S. stimulus outcome.

USD/ZAR: KEY TECHNICAL POINTS TO CONSIDER

- 15.00000 psychological level

- Trendline resistance (short and medium-term)

HIGH IMPACT U.S. DATA SCHEDULED TOMORROW

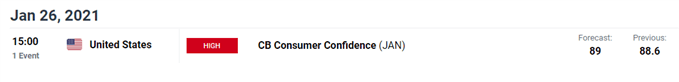

U.S. Consumer Confidence figures are in focus tomorrow (15:00GMT) which is expected higher. This is positive for the greenback should estimates come in as forecasted however, any considerable deviation from estimates could result in notable price swings on USD/ZAR.

--- Written by Warren Venketas for DailyFX.com

Contact and follow Warren on Twitter: @WVenketas