Gold Price Analysis and Talking Points

- US Real Yields Reman Key for Direction of Gold

- Biden Inauguration To Have Little Impact on Gold

- Gold Price Back to Familiar Resistance

US Real Yields Reman Key for Direction of Gold

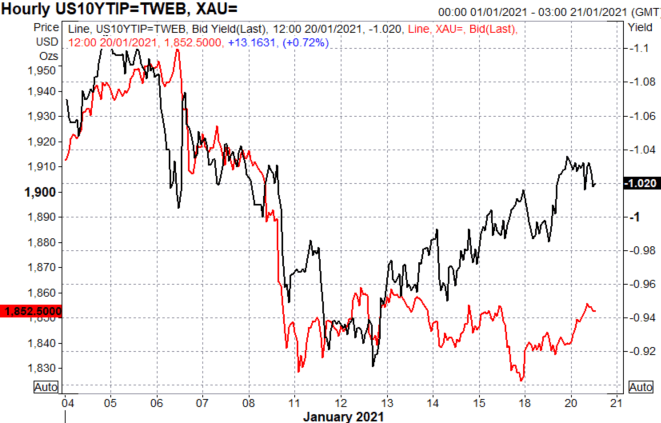

As to be expected, incoming US Treasury Secretary Yellen gave an endorsement for Biden’s stimulus plan, stating that now is the time to “act big” particularly as rates are at very low levels. In turn, with the Treasury and Fed working in unison, this provides a supportive backdrop for gold. That said, the directional signal for the precious metal will be highlighted by the move in real yields, which has pulled back from its recent rise to -94bps. In turn, gold may hold the 1800 level in the short-run, although a move in real yields below -110bps will be needed for a push above 1900.

Gold vs US Real Yields (RHS, Inv)

Source: Refinitiv

| Change in | Longs | Shorts | OI |

| Daily | 1% | -3% | -1% |

| Weekly | 2% | -8% | -2% |

Biden Inauguration To Have Little Impact on Gold

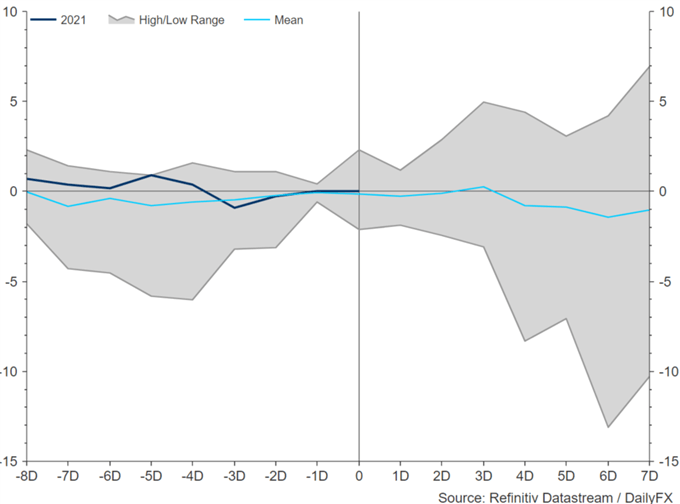

Today is inauguration day as Donald Trump’s presidency comes to an end, although market significance will be most likely minimal. Taking a look at gold’s performance in the chart below, around the time of inauguration day, there is no discernible implications for the precious metal.

Gold Performance During Inauguration Day

Timeline of US Presidential Years on Gold

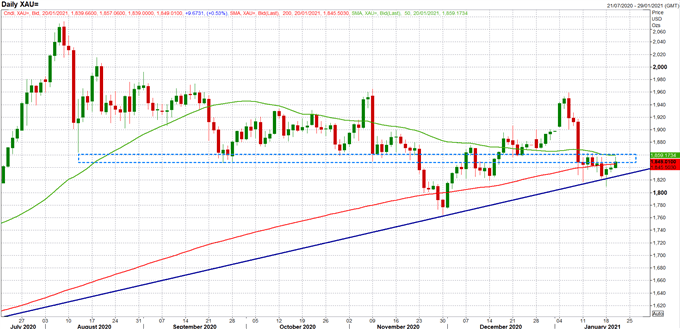

Gold Price Back to Familiar Resistance

Touching on the technicals, gold is back to familiar resistance at circa 1860, which also coincides with the 50DMA. As such, a close above this level will be needed for a continued recovery in the precious metal, which would likely pave the way for a move towards 1890-1900. On the downside, the 200DMA resides at 1845, although, notable support sits at 1820-1830. That said, failure to hold and a break below the trendline puts the November lows in focus 1764.

GOLD PRICE CHART: 1-YEAR TIME PERIOD

Source: Refinitiv

GOLD PRICE CHART: 6-MONTH PERIOD

Source: Refinitiv