Gold Price Outlook:

- Gold has recovered to its 200-day simple moving average after selling off earlier this month

- Still, much resistance lies overhead and previous rallies have lacked the conviction necessary to stage a confident break higher

- Bitcoin vs Gold: Top Differences Traders Should Know

Gold Price Forecast: XAU/USD Recovers but is the Rally to be Believed?

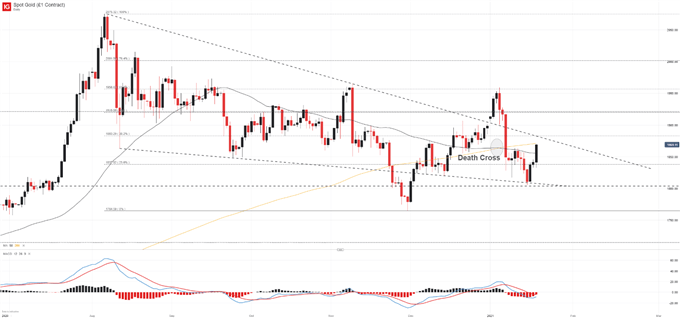

Gold has surged this week as it looks to recover from losses suffered in early January. While the fundamental landscape and tailwinds for the precious metal have remained largely constant, a rise in treasury yields may have worked to erode gold’s standing as a safe haven. Either way, gold has moved off its monthly lows and toward its 200-day moving average which may provide early resistance to a continuation higher.

Gold (XAU/USD) Price Chart: 4 – Hour Time Frame (July 2020 - January 2021)

How to Trade Gold: Top Gold Trading Strategies and Tips

The moving average resides around the $1870 mark and will likely work to influence price in the days ahead. Subsequent resistance might lie at the Fibonacci levels near $1883 and $1920. Resistance marked by the $1956 level may be the important, however, as it coincides with the metal’s peaks in November and January. Thus, it can be argued it is the “line in the sand” that, if broken, could open the door to a longer-term continuation higher as it would curb the series of lower-highs that have been established.

The multitude of resistance overhead might pose a threat to such a continuation and, as a result, the technical case for longer-term bullishness is fragile at this time. With that in mind, resistance could provide potential entry points for bearish exposure in the weeks ahead.

Support likely resides along the Fibonacci level at $1838 with subsequent levels near $1800 and $1764. A break beneath the latter would constitute a considerable technical development that could open the door to a deeper retracement.

While the fundamental tailwinds remain intact, the technical landscape suggests a confident break above $1956 might be required before the downtrend that began in August can be snapped. In the meantime, gold may continue to gradually bleed lower over the longer-term - in my opinion - although gains to the topside could continue in the shorter-term. Follow @PeterHanksFX on Twitter for updates and analysis.

--Written by Peter Hanks, Strategist for DailyFX.com

Contact and follow Peter on Twitter @PeterHanksFX