NASDAQ 100, HANG SENG, ASX 200, ASIA-PACIFIC MARKET OUTLOOK:

- US equities extended gains as reflation trade carried on, tech outperformed

- Alibaba, Tencent under pressure in the wake of US blacklist threat; three telcos fell on NYSE’s U-turn

- US nonfarm payrolls in focus; Bitcoin prices hit 40k before pulling back slightly

Tech-rally, Hang Seng Index, Bitcoin, Asia-Pacific Stocks at Open:

The Dow Jones and S&P 500 index closed at all-time highs on Thursday as the reflation trade carried on after Democrats won two critical seats in Georgia’s Senate runoff elections. A ‘Blue Wave’ outcome means that the Biden administration will take control of both Congress and the White House, which will help to enact their legislative priorities including fiscal and infrastructure spending. The tech-led Nasdaq 100 index soared 2.51%, led by Tesla (+7.9%), Nvidia (+5.78%), PayPal (+3.62%) and Apple (+3.41%).

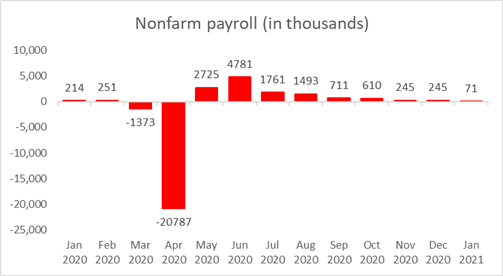

On the macro front, tonight’s nonfarm payrolls data will be closely watched by currency and equity traders. Economists foresee a 71k increase in positions in December, marking a sharp decline from November’s reading of 245k. A downward trajectory of job creating may hint at softer employment market sentiment as pandemic-linked lockdowns interrupts business activity. The US Dollar is very sensitive to the nonfarm figures, and a much worse-than-expected reading could potentially lead the Greenback lower. Find out more on DailyFX calendar.

US Nonfarm Payroll Forecast – Jan 2021

Source: Bloomberg, DailyFX

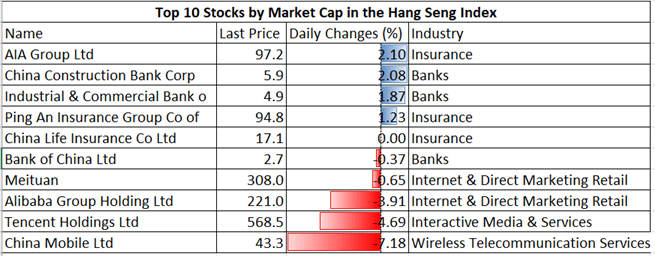

In Asia, share prices of Tencent and Alibaba fell sharply on Thursday in the wake of US threatening to add the two Chinese tech giants into a blacklist over alleged ties to local military and security services. The NYSE made another U-turn saying it will delist three Chinese telecom companies from January 11th, sending inconsistent messages to investors that led to heightened price volatility. China Mobile plunged 7.2% on Thursday. The Hang Seng Index may weather political headwinds as the Trump Administration tilted more hawkishly against Chinese firms before the power transition this month.

Hang Seng Top 10 Stock Performance 08-01-2021

Source: Bloomberg, DailyFX

Australia’s ASX 200 index opened mildly higher, led by information technology (+1.69%), energy (+1.02%) and consumer discretionary (+0.63%) sectors, while real estate (-1.07%) and materials (-0.74%) lagged behind. Copper, iron ore and nickel prices extended gains on fresh stimulus hopes in view of “Blue Wave” and a global cyclical upswing. Australia’s metal and mining giants Fortescue Metals (-1.58%), Rio Tinto (-1.28%) and BHP Group (-0.75%) saw their prices pulling back slightly from recent highs.

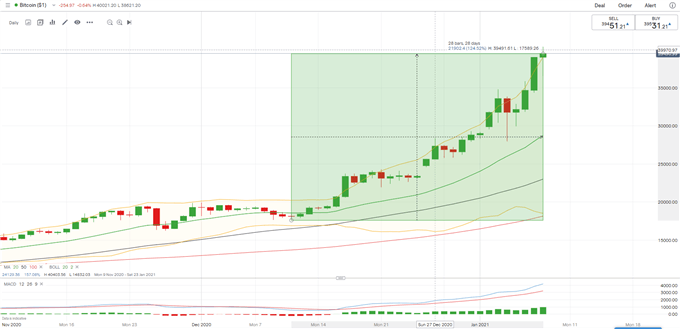

Bitcoin prices hit the $40k mark on Friday morning before pulling back slightly, stretching a one-month gain beyond 120%. Cryptocurrencies outshined other asset classes this year, propelled by a weakening US Dollar and demand for hedge against seemingly unlimited quantitative easing. The relentless rally in Bitcoin reflects strong investor appetite for non-fiat assets in view of potential pick-up in inflation as well as ample liquidity environment. Bitcoin’s market cap surpassed US$ 700 billion, which is still a small fraction of the 10 trillion market value of gold. Since there are only 21 million Bitcoins that can be mined in total, the scarcity appears to have driven up the prices.

Bitcoin

Chart by IG

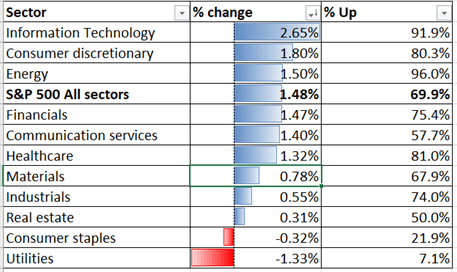

Sector wise,9 out of 11 S&P 500 sectors ended higher, with 69.9% of the index’s constituents closing in the green on Thursday. Information technology (+2.65%), consumer discretionary (+1.80%) and energy (+1.50%) were among the best performers, whereas defensive-linked utilities (-1.33%) and consumer staples (-0.32%) were lagging behind.

S&P 500 Sector Performance 07-01-2021

Source: Bloomberg, DailyFX

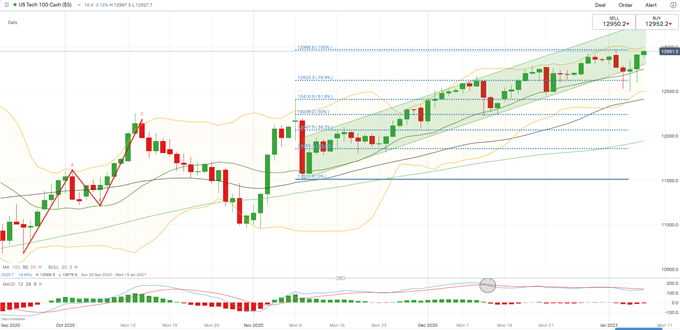

Nasdaq 100 Index Technical Analysis:

Technically, the Nasdaq 100 index is edging higher within an “Ascending Channel” as highlighted in the chart below. The uptrend is well-supported by its 20-Day Simple Moving Average (SMA) line, which is at 12,750 now. Immediate support and resistance levels can be found at 12,623 (76.4% Fibonacci extension) and 12,960W (100% Fibonacci extension) respectively.

Nasdaq 100 Index – Daily Chart

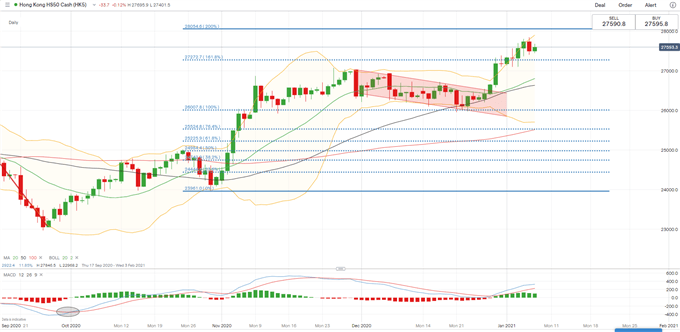

Hang Seng Index Technical Analysis:

The Hang Seng Index (HSI) likely broke a “Descending Channel” (chart below) two weeks ago with strong upward momentum. The index has also cleared a key resistance level at 27,270 – the 161.8% Fibonacci extension, thus opening the door for further upside potential with an eye on 28,050 – the 200% Fibonacci extension. Overall momentum remains bullish biased, as suggested by the MACD indicator.

Hang Seng Index – Daily Chart

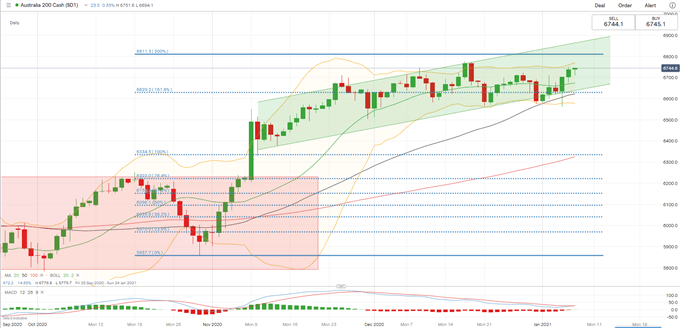

ASX 200 Index Technical Analysis:

The ASX 200 index rebounded from the lower bound of the “Ascending Channel” and has moved higher since. Immediate support and resistance levels can be found at 6,630 (the 161.8% Fibonacci extension) and 6,810 (the 100% Fibonacci extension) respectively. The MACD indicator is about to form a “Golden Cross”, which may hint at further upside potential.

ASX 200 Index – Daily Chart

--- Written by Margaret Yang, Strategist for DailyFX.com

To contact Margaret, use the Comments section below or @margaretyjy on Twitter