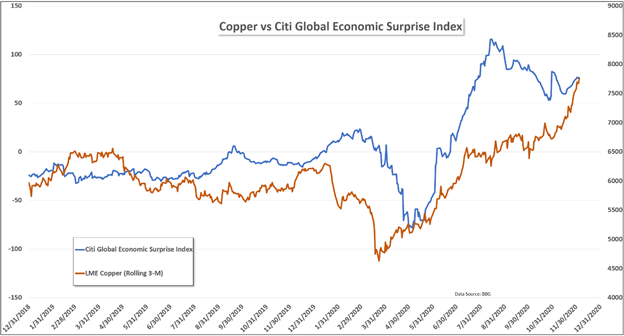

Copper 1Q Forecast: May Rise Further as Post-Covid Economic Outlook Clears

Copper prices plummeted in Q1 2020 as Covid forced governments to enact economically crippling lockdown measures. Global data improved by the second half of the year, beating initial estimates from central banks and governments. Copper's 2020 swing low preceded these data beats and went on to reach highs not seen since 2013 – see chart below. The red metal’s ability to act as a bellwether for economic growth is well established, hence the pseudonym, “Dr. Copper.”

LME Copper vs Citi Global Economic Surprise Index

Chart prepared by Thomas Westwater, data from Bloomberg

In response to the impending pandemic, central banks took swift action to shore up resiliency in financial markets. In March, the Federal Reserve led the way with a rarely seen emergency rate cut that occurred in-between normally scheduled policy announcements. The fiscal side, while not as persistent, provided unseen amounts of aid, complementing monetary effects on the economy. Moreover, economists now estimate an accommodative monetary environment into 2022-2023.

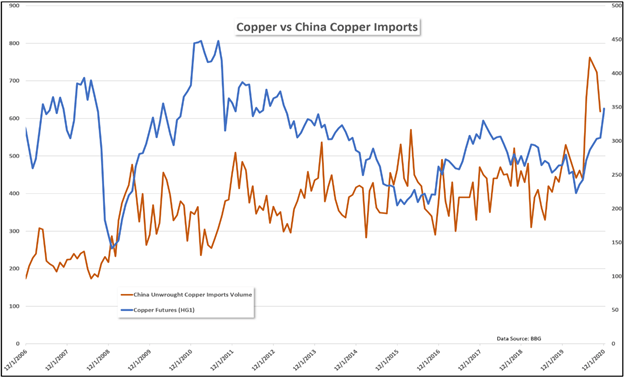

Copper vs Chinese Copper Imports

Chart prepared by Thomas Westwater, data from Bloomberg

Health officials now expect widespread vaccine distribution by H2 2021. Adequate vaccination levels would allow a return to "normal," further reinforcing economic output. China, the largest demand-side price driver, imported record-breaking levels of unwrought copper in 2020. Unparalleled demand is likely to continue as infrastructure investment will be key to China's optimistic growth plans. That said, copper may continue to rise into fresh multi-year highs as fundamental drivers appear set to strengthen in 2021.