USD/SGD 1Q Forecast: US Dollar at Risk to Singapore Dollar Amid Hunt for Yield in Emerging Markets

The Singapore Dollar may continue its advance against the US Dollar in 2021 as capital keeps flowing into Emerging Markets. Things initially weren’t looking well for SGD during the peak of the coronavirus outbreak, especially considering Singapore’s externally-focused economy. The island-nation is expected to see growth contract 6% in 2020. In fact, Singapore’s benchmark stock index, the Straits Times Index (STI), spent most of its time in 2020 lagging behind its regional peers’ equities, such as in China and India.

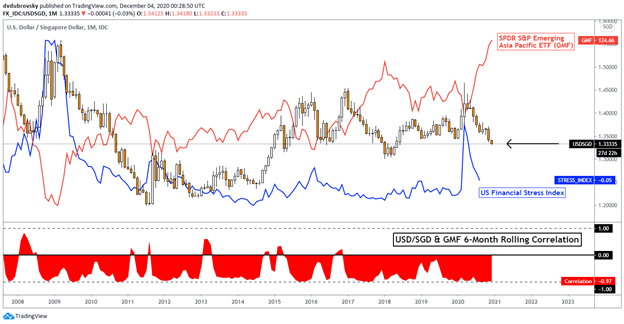

What makes USD/SGD unique – apart from how the Monetary Authority of Singapore conducts policy – is its sensitivity to broader risk appetite. Below, I have highlighted the consistent inverse relationship between the pair and the SPDR S&P Emerging Asia Pacific ETF (GMF). Investors poured capital into the latter as US financial conditions and APAC 2021 growth expectations improved, pushing the GMF to all-time highs. This is as the Singapore Dollar rose to its strongest against the anti-risk US Dollar since 2018.

There are a few things that I think will keep USD/SGD under pressure in 2021. These are better handling of Covid in the APAC region as a vaccine/s becomes available, investors searching for yield in a zero-interest-rate environment and a departure from what has been the tense, confrontational approach for the US against China in the form of trade wars. President-elect Joe Biden will likely keep the latter on their toes due to domestic pressure, but what is appearing to be in a more strategically cautious angle that may keep volatility low.

USD/SGD – Monthly Chart

Chart prepared by Daniel Dubrovsky, created with TradingView