Key Talking Points:

- The ECB may use verbal pushback to weaken a solid euro

- Brexit talks continue to be at an impasse despite Johnson and von der Leyen meeting

- EUR/USD and EUR/GBP key levels to watch

ECB TASKED WITH WEAKENING THE EURO

The European Central Bank’s (ECB) monetary policy meeting today will be the main focus of euro traders as EUR/USD ventures into risky territory above the 1.20 line. It’s expected that its president, Christine Lagarde, is to announce an expansion of 500 billion euros to the Pandemic Emergency Purchase Program (PEPP), which would be positive for the common currency. But given reactionary measures are almost entirely priced in, it would take a much larger expansion than expected to shock markets and send the euro higher.

The main focus today will be the press conference to be held after the announcement, where Lagarde may talk about the strength of the common currency and its negative effect on inflation, possibly signaling that the Bank will be keeping a close eye on its performance in the coming weeks.

But the ECB might have little room to actually make a significant impact on weakening the EUR/USD exchange rate, given it is largely rising on the back of US Dollar weakness given improved expectations of economic recovery following positive vaccine developments, and expectations are for it to continue depreciating into 2021.

And whilst the ECB does not officially target the exchange rate, Lagarde cannot ignore the euro’s rapid rise, so her aim will be to talk down the currency by hinting at possible policy action in the near future.

In fact, Lagarde and other ECB board members will be speaking in the 24 hours after the meeting on Thursday, which is likely a tactic to allow for further policy talk depending on how markets react to the monetary meeting.

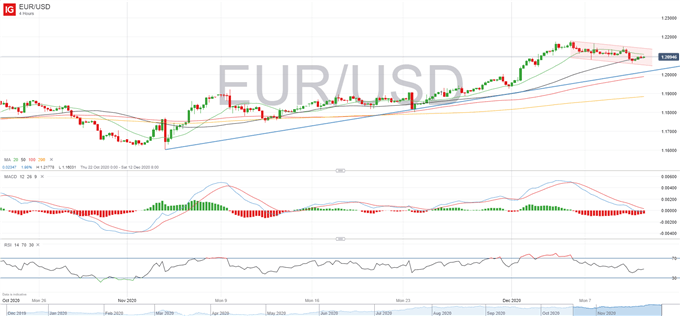

EUR/USD4-hour Chart

EUR/USD has slipped below the 20-period moving average on the 4-hour chart, with the RSI falling towards the 30 line, which signals that bears are in control in the short-run. Price action has formed a descending channel so we could expect to see bulls attempt to break the upper limit at 1.2140, pushing bullish momentum further towards yearly highs at 1.2177.

On the flip side, further increase to selling pressure could see the inferior limit of the channel broken at 1.2050, pushing lower towards the rising support trendline from the lows since November 4th at 1.2018.

BREXIT HOPES FADE

Last night we saw Boris Johnson head to Brussels for a last-chance meeting with European Commission President Ursula von der Leyen in an attempt to break the Brexit impasse as the end-of-year deadline is fast approaching. The only thing we have gained from this meeting is another deadline, this Sunday, which I wouldn’t be surprised if it becomes another one of those “soft” deadlines that can easily be broken with a promise of further talks.

Again we’ve seen Bank of England governor Andrew Bailey warn about the detrimental effect of a no-deal scenario on the UK economy, which is feared to be worse than the impact of Covid-19; even worse when put together.

EUR/GBP Daily chart

On the daily chart, EUR/GBP has shown resilience since breaking out of the descending triangle back at the beginning of December. There is still a way to go to reach the 0.92 mark, which is in near confluence with the 23.6% Fibonacci, but continued bullish momentum is likely to bring a break of this resistance and head towards post-coronavirus highs seen in September at 0.9292.

To the downside, strong support is likely to emerge at the 0.90 psychological line where the 50 and 200-day moving averages are converging.

Learn more about the stock market basics here or download our free trading guides.

--- Written by Daniela Sabin Hathorn, Market Analyst

Follow Daniela on Twitter @HathornSabin