Brexit Outlook and Sterling (GBP/USD) Price, Analysis and Chart:

- A meeting between two leaders may point to a deal.

- The UK removed contentious Internal Market Bill clauses.

- Retail short GBP/USD according to sentiment guide.

EU/UK post-Brexit talks continue today against a mildly positive backdrop after UK PM Boris Johnson announced that he would be meeting EU Commission President Ursula von der Leyen in person later this evening in Brussels. With the clock running down, this may be seen as the final push to get a deal done if it is to be ratified by the EU ahead of the December 31 deadline. Both sides continue to say that major differences remain, but it may be that tonight’s meeting has been set up to provide the moment that a landing ground is found between the two parties.

On Tuesday, the UK government said that it would drop the parts of the Internal Markets Bill that had upset the EU and would not re-introduce them even if the two sides failed to reach a trade deal. The EU had warned the UK that the offending clauses in the Bill would make it much harder to reach a trade deal. As always with anything to do with EU/UK trade talks, there will be constant rumor and counter-rumor throughout the day and traders should be wary of unsubstantiated noise and only look to trade any official statement/s.

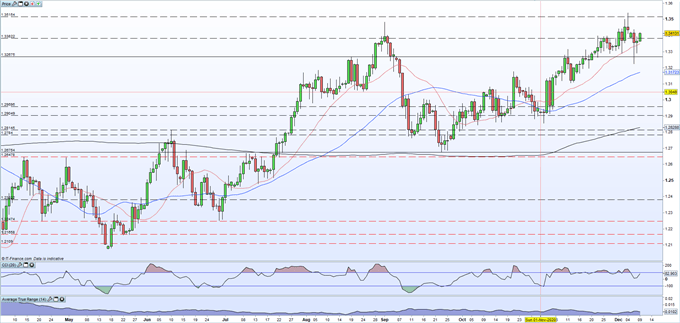

Cable is back above 1.3400 after having touched a low of 1.3224 on Monday and continues to benefit from a positive moving average set-up. A trade deal between the EU and UK, even if it is ‘skinny’ will give GBP/USD the motivation to break back above the recent 1.3540 high and trade at levels last seen in May 2018. On the weekly chart, highs at 1.3792 and 1.4032 can be seen and will likely cap any short-term upside movement.

Moving Averages Explained for Traders – Visit the DailyFX Educational Section for More Articles

GBP/USD Daily Price Chart (April - December 9, 2020)

| Change in | Longs | Shorts | OI |

| Daily | 3% | -7% | -3% |

| Weekly | 4% | -10% | -5% |

IG client sentiment data show 39.39% of traders are net-long with the ratio of traders short to long at 1.54 to 1. Yet traders are less net-short than yesterday and compared with last week. Recent changes in sentiment warn that the current GBP/USD price trend may soon reverse lower despite the fact traders remain net-short.

Do you want to discover what kind of Forex Trader you are? Take the interactive DNA FA Quiz

What is your view on Sterling – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.