CANADIAN DOLLAR PRICE OUTLOOK: USD/CAD, CAD/JPY, NZD/CAD

- USD/CAD price action has shed about 50-pips so far this week through Wednesday

- CAD/JPY has potential to extend lower while NZD/CAD might surrender recent gains

- The Canadian Dollar could continue following the broader direction of crude oil prices

Canadian Dollar price action has been mixed so far this week with the Loonie gaining ground against the Greenback but weakening relative to the Japanese Yen and New Zealand Dollar. USD/CAD has declined roughly 50-pips from last Friday’s close with CAD/JPY dropping by a similar magnitude. NZD/CAD continues to climb with spot prices up about 60-pips week-to-date. That said, in addition to the direction of crude oil prices, the Canadian Dollar appears predominantly driven by performance of its FX counterparts.

USD/CAD PRICE CHART: DAILY TIME FRAME (19 JUN TO 18 NOV 2020)

USD/CAD price action has edged lower largely on the back of broad-based US Dollar weakness. The major currency pair might be due for a rebound higher, however, as indicated by the intraday reversal off the 1.3040-price level. This development seems to have formed a bullish hammer candlestick.

| Change in | Longs | Shorts | OI |

| Daily | 6% | -9% | -3% |

| Weekly | 44% | -23% | -3% |

Reclaiming the 8-day moving average could open up the door for USD/CAD bulls to set their sights on last week’s swing high near the 1.3170-area. Potential for an upward move might warrant additional credence if market sentiment deteriorates, which would likely correspond with an uptick in market volatility and selloff in crude oil.

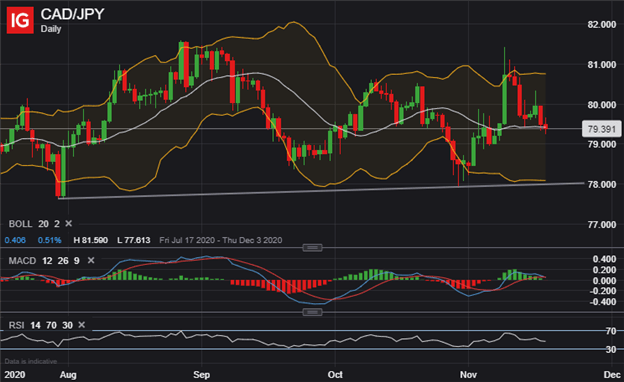

CAD/JPY PRICE CHART: DAILY TIME FRAME (17 JUL TO 18 NOV 2020)

Similarly, if trader risk aversion garners more traction, which started to show during Wednesday’s trading session, the Canadian Dollar might slide further against the safe-haven Japanese Yen. The impending MACD crossover suggests CAD/JPY price action could face further selling pressure - perhaps toward the 78.000-handle. This area of technical support is highlighted by the positively-sloped trendline extended from the 30 July and 29 October swing lows as well as its bottom Bollinger Band.

NZD/CAD PRICE CHART: DAILY TIME FRAME (18 JUN TO 18 NOV 2020)

NZD/CAD price action has climbed over 250-pips this month, but once again, the move seems largely owed to New Zealand Dollar strength rather than Canadian Dollar weakness. That said, the relative strength index is running into ‘overbought’ territory and hints at potential upside exhaustion. A systemic risk-off move could catalyze a reversal lower in NZD/CAD with the 0.8950-price level eyed as resistance-turned-support.

Keep Reading - CAD & Oil: Canadian Dollar to Crude Oil Correlation

-- Written by Rich Dvorak, Analyst for DailyFX.com

Connect with @RichDvorakFX on Twitter for real-time market insight