Brexit, FTSE and GBP/USD Price, Analysis and Chart:

- FTSE back to lows last seen in April.

- Brexit talks continue – is no news, good news?

- GBP/USD back above 1.2900.

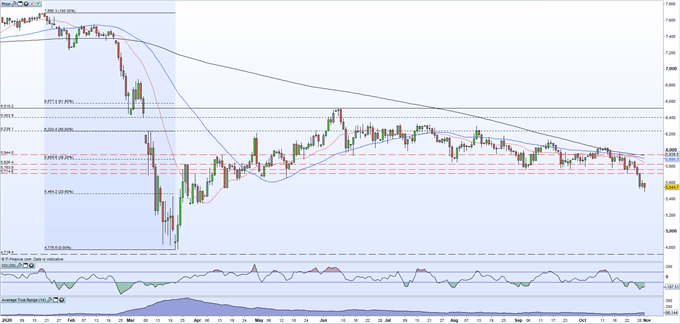

The FTSE 100 continues to show signs of stress and is trading back at lows last seen in April this year after the government confirmed further regional lockdowns yesterday. Nottinghamshire has been moved into tier 3 restrictions, while West Yorkshire will also be placed under the strictest level of rules on Monday. The FTSE is now closing in on the 23.6% Fibonacci retracement of the January 20/March 22 move, underlining the weakness in the index.

FTSE 100 Daily Price Chart (January – October 30, 2020)

There has been little in the way of any news flow from the latest round of EU-UK trade talks which continue in Brussels today. The European Commission president Ursula von der Leyen did say that the talks were making good progress but that fisheries and level playing field issues remain, and until these are solved then progress will likely stall. It is expected that UK PM Boris Johnson will meet with Ms. Von der Leyen next week in an effort to break the current gridlock.

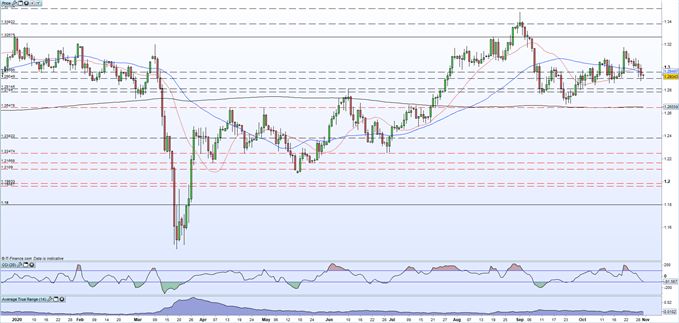

The British Pound has picked up a small bid ahead of the weekend, helping GBP/USD back above 1.2900. The pair traded as low as 1.2876 yesterday as the US dollar rallied in the afternoon session on further Euro weakness. Cable has made a series of lower highs and lower lows over the last few days and will remain under pressure ahead of any Brexit news.

GBP/USD Daily Price Chart (January – October 30, 2020)

| Change in | Longs | Shorts | OI |

| Daily | 3% | -7% | -3% |

| Weekly | 4% | -10% | -5% |

IG client sentiment data shows 52.68% of traders are net-long with the ratio of traders long to short at 1.11 to 1.We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests GBP/USD prices may continue to fall.Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger GBP/USD-bearish contrarian trading bias.

Traders of all levels and abilities will find something to help them make more informed decisions in the new and improved DailyFX Trading Education Centre

What is your view on Sterling – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.