DOW JONES, HANG SENG INDEX OUTLOOK:

- Dow Jones Industrial Average (Dow) futures fluctuate in early trading hours

- Hang Seng Index (HSI) may open higher as Evergrande manages to avoid a severe liquidity crunch

- Hong Kong market will enter a two-day holiday form 1st Oct, China market will shut for 8 days

Dow Jones Index Outlook:

Dow Jones Industrial Average index (Dow) futures oscillated ahead of the first presidential debate after registering small losses overnight. The debate will be closely watched by investors and traders around the world, and may have a relatively large impact on currencies, gold, crude oil and index futures, which are usually tradable 24 hours a day.

Even though recent polls suggest that Joe Biden is a clear front-runner at the moment, the odds that Donald Trump may again defy preconceived forecasts exist. Thus, a face-to-face debate between the two drastically different candidates is worth traders’ precious time. Several key debate topics include the coronavirus pandemic, the economy, protests and violence, and the integrity of the election itself.

Today’s key economic data include official and Caixin versions of Chinese manufacturing PMIs, final UK and US Q2 GDP final figures, as well as Germany unemployment statistics. Read more on our economic calendar.

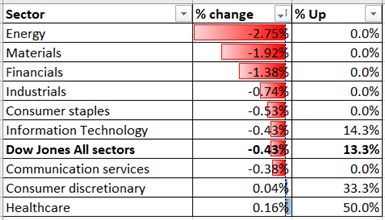

Sector-wise, 7 out of 9 Dow sectors closed in the red, with 86.7% of index constituents ending lower. Energy (-2.75%), materials (-1.92%) and industrials (-1.38%) were among the worst performers, while healthcare (+0.16%) and consumer discretionary (+0.04%) struggled to hold small gains.

Dow Jones Index Sector performance 29-9-2020

Source: Bloomberg, DailyFX

Technically,the Dow has likely formed a bullish “AB=CD” pattern and has since rebounded from the “D” point (chart below). It reversed lower after touching an immediate resistance level at 27,600 (20-Day SMA), and thus failed to penetrate into the upper Bollinger Band immediately. The MACD indicator may be about to form a “bullish crossover”, suggesting that the trend is perhaps gaining upward momentum. A solid breakthrough above the 20-Day SMA may open room for more upside.

Dow Jones Index – Daily Chart

Hang Seng Index Outlook:

Hong Kong’s Hang Seng Index (HSI) may shrug off negative news surrounding one of China’s largest property developers – Evergrande (333 HK) – after the company managed to strike a debt deal with its strategic investors to avoid an immediate liquidity crunch. Some 86.3 billion yuan of its convertible debt will be rolled over with investors’ consent. The incident underscored tough situations faced by mainland developers, with regulators recently tightening leverage rules amid economic slowdown.

As Hong Kong market enters into a two-day National Day holiday, investors may prioritize risk management and may choose to stay on the sidelines before the long weekend.

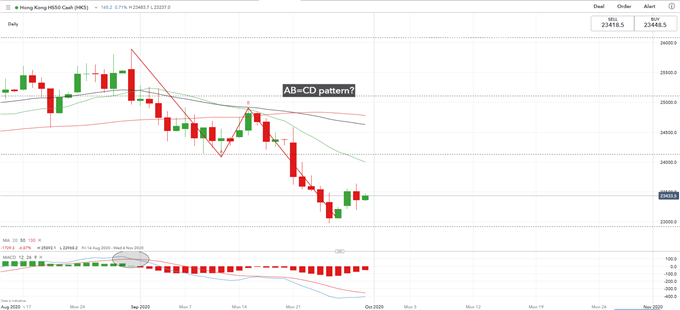

Technically, the HSI has likely formed a bullish “AB=CD” pattern with the “D” point found at around 23,070. The index has since rebounded from the “D” point, opening room for more upside towards the next resistance levels at 23,700 and 24,160.

Hang Seng Index – Daily Chart

--- Written by Margaret Yang, Strategist for DailyFX.com

To contact Margaret, use the Comments section below or @margaretyjy on Twitter