DAX 30 Forecast:

- The DAX 30 is on pace for a noteworthy weekly loss after a key trendline was breached

- With prior support broken, the DAX might struggle to find another area nearby with technical merit

- The New DAX Decade: The Past, Present and Future of the DAX 30

DAX 30 Price Outlook: German Index Broke Trendline Support, Now What?

The DAX 30 has fallen under selling pressure this week alongside US indices which have been a source of weakness for risk assets. Despite a clear domestic catalyst or heightened exposure to technology like that of the Nasdaq 100, the DAX 30 suffered a significant technical break. As a result, it seems the DAX 30 is in a precarious position should equity weakness persist.

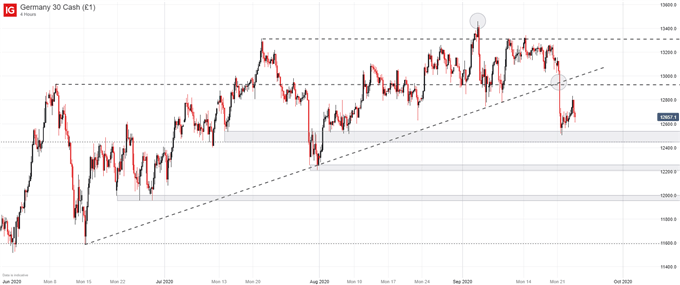

DAX 30 Price Chart: 4 - Hour Time Frame (June 2020 – September 2020)

The newfound vulnerability stems largely from the breach of the ascending trendline from mid-June. The level had helped guide the DAX higher since its inception, even withstanding multiple tests in early September. While sturdy, the level was not bulletproof and Monday’s selloff carried the conviction require to break the line, quickly allowing further losses once it was breached.

Subsequent losses followed until support near the Fibonacci level at 12,450 helped to ward off deeper declines. To be sure, the DAX will likely look to this area for initial support in the event of renewed bearishness. If broken, the index might extend lower with the 12,200 mark potentially acting as an area of secondary support. While a recovery effort has been started, risk assets remain in a fragile state in my opinion, leaving the DAX 30 susceptible to further losses.

| Change in | Longs | Shorts | OI |

| Daily | -9% | 7% | 2% |

| Weekly | -27% | 9% | -5% |

Further still, IG client sentiment data suggests similar as long exposure has quickly overtaken short interest. Since we typically take a contrarian view to sentiment data, the shift in positioning could be a sign the DAX 30 has further to fall. Thus, shorter-term recoveries might create potential entry points that look to capitalize on renewed weakness. In the meantime, follow @PeterHanksFX on Twitter for updates and analysis.

--Written by Peter Hanks, Strategist for DailyFX.com

Contact and follow Peter on Twitter @PeterHanksFX